Financial Services

Financial Services

- Insights

- Financial Services

- Article

4 Fundamental Aspects of Sales-oriented Digital Engagement Policy for Banks

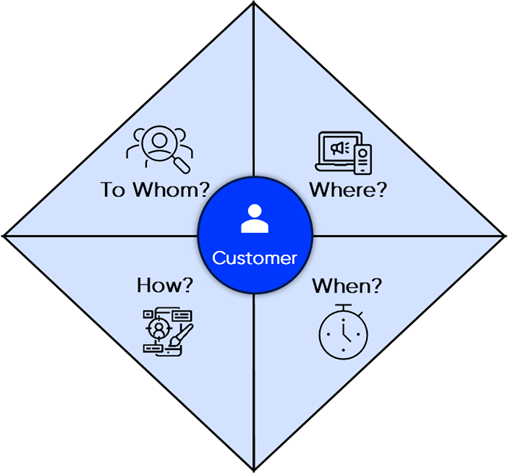

As we all know, banks use digital channels as sale platforms in addition to enabling customers to make their financial transactions easily. That is a good strategy because they can reach millions of customers very quickly and sell a financial services product with just a few clicks, which is a lot easier and less costly with respect to the process on non-digital channels. Therefore, creating and following a sales-oriented customer-centric digital engagement policy is essential for all banks. In this article, we will dive into the four base aspects of that strategy namely To Whom?, Where?, When? and How?

To Whom?

An ideal sales-oriented digital engagement policy should be built around the customer who is the end beneficiary of the financial service. To increase her effectiveness, you need the know your customer more than herself. It is vital to know whether they are in the “have money” or “need money” phase, their propensities towards fundamental financial services products, their login frequencies, etc.

Creating and following a smart sales-oriented digital engagement strategy is only possible by using the aforementioned (and much more) parameters for each customer. Otherwise, campaigns are prone to have comparably low conversion rates because they are not meant for the right customer. For example, if you offer an investment product to a customer segment who are in the “need money” phase, then the conversion rate will most possibly be lower than your intention.

The login frequency of customers is also another important metric. It shows how many in-app offering occasions you can have with your customer. Note that it is different than the number of logins. Distribution of this login over time gives one insight. Distribution of this information across customers provides another insight. For example, if you have an average login frequency of 20 times a month, you may observe that most of the customers actually log in less than 5 times in a month. This also shows that targeting the right customer with the right offer is crucial since each unfulfilled offer means a wasted chance for another potentially successful offer.

Where?

Alright, let’s say you know your customers very well and you integrated their data into your related customer engagement systems. Where do you place your offerings on digital platforms, and which channels to leverage?

There are several ways to engage with your customer in our digital world. The most common ones that banks use nowadays are push notifications, SMS, and e-mail. Our experience shows that, for digital active customers, e-mail and SMS should only be used to lure customers to the application rather than offering banking products. OK, we got the customer to the app. Now what? You should build some additional offering areas on your mobile app. Here are some good examples of offering areas from the benchmark;

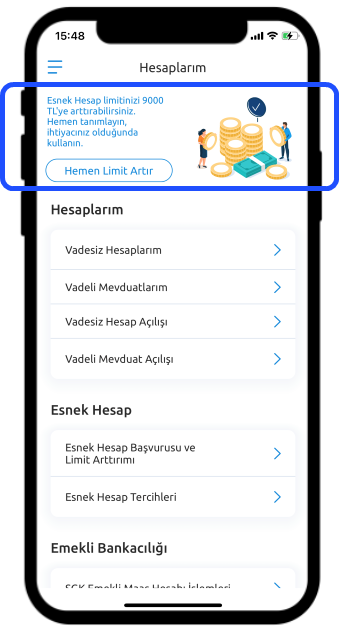

Drawer Page

Drawer Page

- The most effective sales area

- Should be used for most profitable offers

- Remarketing actions can be taken according to customer response to the drawer page offering

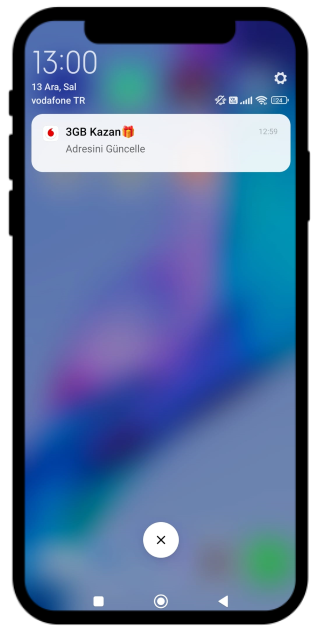

Push Notification

- The easiest method to lure the customer to the application

- The main way to engage with customers for the moment of truth scenarios

- Clear and simple language should be used as in the example

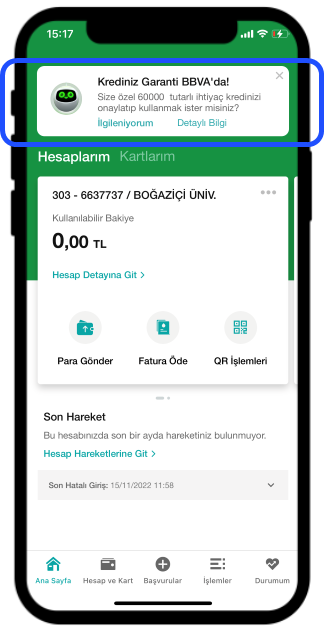

Main Menu Special for You

Main Menu Special for You

- An always-on-offering area for digitally active customers

- The best area to place personalized offerings

- Can be integrated with the chatbot

Sub Menu

- Can be used to inform customers about preapproved products

- Should be the main area to show unfinished product applications

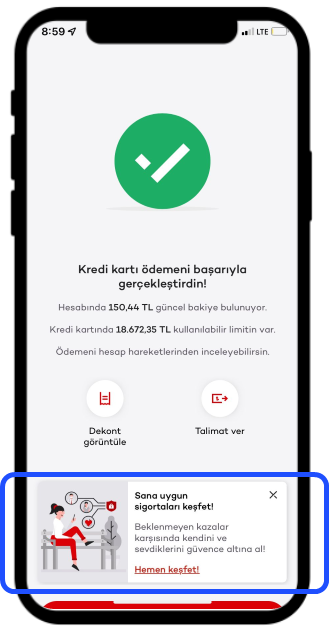

End of Transaction

- The best place for cross-sell offerings

- Suitable for moment-of-truth scenarios and transaction-related offerings

- The best time for offerings since the customer has done the transaction s/he intended to

There should also be a contact policy for each of these areas to avoid missing opportunities or causing customer blindness. Therefore, it should be beneficial to monitor the distribution of the number of defined & showed campaigns per customer to measure the overall effectiveness and performances of these areas.

Additionally, there might be some customer segments that are not suitable for your fundamental banking products. Although you might not sell a product to them, you can still deepen your relationship with that customer segment. For example, you can offer campaigns like automated bill payment orders and keep your bond active.

When?

The financial situation of customers varies over time. Thus, finding the right moment for offers is crucial for success. Each banking offer should be tested at different times and frequencies with A/B testing method in order to find the most effective time for each of them. For example, as a result of such tests, we recommend our customer show pre-approved loan drawer page offerings at least once a month for the suitable customer segment since it boosts loan sales significantly.

Apart from batch offerings, there should be the moment of truth offering scenarios that work with real-time streaming customer data. Moment-of-truth scenarios are created to catch the right customer at the right moment with the right product to meet the exact need of that customer and close the sales at that moment. As a simple example, when the balance on the checking account of a customer drops below 100 dollars, a push notification to open an overdraft account can be sent to the customer as we know he/she is in need of money at that exact moment and the possibility of convincing that customer to open an overdraft account offer is much higher than any other moment.

How?

The “how” phase is kind of related to selecting the right words and designing the campaign images. There is an art of it, but there is also the science of it. You should have a ruleset and guidelines that you should leverage for every campaign and be consistent across the entire campaign strategy. There can be many criteria to elaborate around this chapter, but here I decided to list the three fundamental ones for a sales-oriented user-centric campaign.

You should be;

- Crystal Clear

- Action-Taking

- Informative

The campaigns should be clear and understandable at the very first glance. No need to make the customer frustrated or question something. Use simple words and give just the necessary information. Don’t try to make it fancy with complex words, be simple.

The campaigns should also be action-taking. You should tell the customer exactly what he needs to do in the context and give him access to the necessary deep links. For example, if it is an application offer for a prepaid credit card, clicking on the push notification should direct the customer to the application page in the mobile application, not to the login page.

The campaigns should also be informative. Telling the campaign reward at the beginning of the content lures the customer to read the full context where you give all the necessary information to get the reward. Consequently, the customer knows what to get as a reward and how to get it making the offer more effective.

To sum up, in this article, we dived into the four fundamental aspects of sales-oriented digital engagement policy and gave some flavors of it through our real-life example. Although there are much more things to cover, we believe that addressing the aforementioned fundamental areas will give you a head start. As the Digital Revenue Services team in DefineX, we are specialized in these aspects. We can come and deeply analyze your case, identify improvement areas, and convert them into real, sizeable business outcomes with our seasoned team of experts.

For more information and business inquiries about Digital Revenue Services, you can contact Funda Karakaşoğlu, our head of business development: funda.karakasoglu@teamdefinex.com.

This article was written by Enes Sarı, a business analyst in our Digital Revenue Services. You can get in touch with Enes for your questions and more information about the methodology: enes.sari@teamdefinex.com

Explore deep-dive content to help you stay informed and up to date

Financial Services

Financial Services

Financial Services

Financial Services

How did IsBank save 67,351 hours a year by automatizing the financial analysis process?

Read now Financial Services

Financial Services