- Insights

- Financial Services

- Blogs

Build Long-Lasting Relationships with Your Credit Card Customers by Leveraging Extrinsic Benefits

Turkish banks are playing in the Premier League of the credit card industry, both in terms of technology infrastructure and the innovative products and services they offer to their customers. For instance, while BNPL is gaining popularity in the global banking industry, Turkish banks have been enabling their customers to make installment payments through credit cards since 1998. As of November 2022, 26% of Turkey’s total transaction volume is attributed to payments with installments, a testament to the widespread use and success of this payment method.

In such an innovative and competitive market, where customers hold an average of 1.46 credit cards each, becoming the go-to brand for credit card usage is as important as selling credit cards. In this article, I would like to share some valuable insights we have gained on this topic and provide suggestions for building long-lasting relationships. Before delving into practical tips, let’s first establish some theoretical foundations.

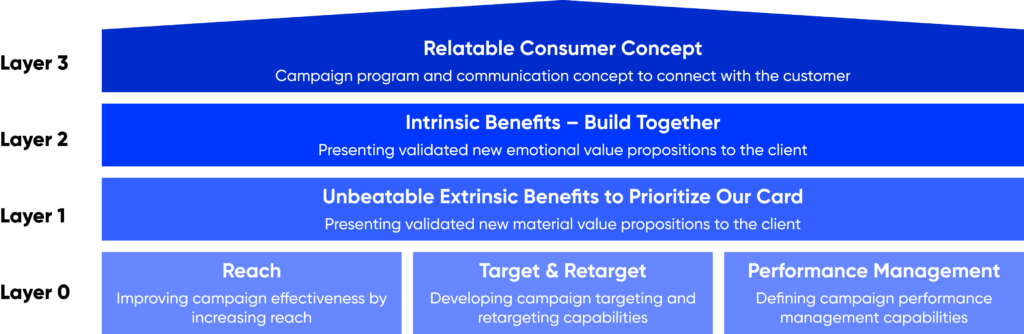

Figure 1: DefineX Credit Card Customer Relationship Enhancement Framework

The above figure illustrates our framework for enhancing credit card customer relationships across several layers. By integrating technical capability, growth marketing, and effective communication, the DefineX framework enables a holistic approach to enhance the customer experience.

Layer 0, the mechanical layer, consists of reach, target/retarget, and performance management capabilities, along with other technical capabilities that support these functions.

Layer 1, the financial benefits layer, focuses on optimizing the campaign impact and accelerating transaction growth by leveraging extrinsic benefits such as reward points to incentivize the customers. Our goal in this layer is to maximize return on marketing investment.

Layer 2 marks the transition from a mechanical to a personal relationship, where we aim to build emotional bonds with card customers. Intrinsic benefits are offered to encourage long-term customer loyalty as emotional connections are critical to building long-lasting customer relationships.

Layer 3 represents the ultimate stratum of our framework, where we strive to establish a unified and personalized communication language to connect with our customers on a deeper level. By creating customized and relevant messaging, we aim to foster long-term customer engagement and loyalty.

Now that we have outlined our framework, let’s delve into how we apply it, particularly Layer 1, to our projects. In today’s environment, where customers are increasingly aware of loyalty programs and their benefits, effective management of extrinsic benefits is critical to customer acquisition and retention. The primary extrinsic benefits that banks can offer to their customers include reward points, cashback, and interest-free installments. While reward points and cashback are effective in gaining market share in small to medium-basket-size payments and recurring transactions, interest-free installments are more effective for higher-basket-size purchases. As the basket size increases, interest-free installment options become critical for customers to manage their cash flows. Our experience has shown that each additional interest-free installment on high-basket size purchases can result in a 10 to 20 basis point increase in market share for merchant category. In the rest of this article, I will explain how to develop an offer strategy to optimize extrinsic benefits and gain a competitive edge in the credit card industry.

SET SIMPLE TARGETS FOR YOUR CUSTOMERS

With customer attention span down to 8 seconds, it is critical to present campaigns that are clear, concise, easy to understand, and not perceived as yet another distraction. Complicated or even deceptive campaigns with multiple conditions can discourage customers and harm your reputation. In contrast, setting simple and straightforward targets to earn reward points tends to work much better. Campaigns that require customers to take multiple actions or meet complex requirements are often categorized as difficult campaigns.

For example, one of our clients achieved a 7-10% win-back rate for inactive customers in the last 3 months by presenting a simple campaign offering a “50% off first purchase”. Conversely, difficult campaigns that required customers to jump through multiple hoops had an activation rate of only 2-5%.

COMPLETE YOUR MERCHANT CATEGORY MIX MODEL

To become the preferred credit card of your customers, it is crucial to ensure that they use your card for shopping in the main categories. In the Turkish credit card issuing market, the total market share of sectors in the merchant category mix model is %53. However, simply having a high market share in a category does not guarantee that customers will use your credit card for spending in that category. For example, even though the grocery industry has the highest market share, accounting for between 16-20% of total transaction volume, approximately one out of four active card customers in our clients do not use our clients’ cards for grocery spending. In other words, they use another bank’s credit card or cash. To prevent this leakage in these key categories, it is essential to iteratively design and test lean campaigns for non-users. By analyzing their spending patterns and offering targeted incentives, you can encourage them to switch to your credit card.

OUTLINE A CUSTOMER-BASED DEEPENING STRATEGY

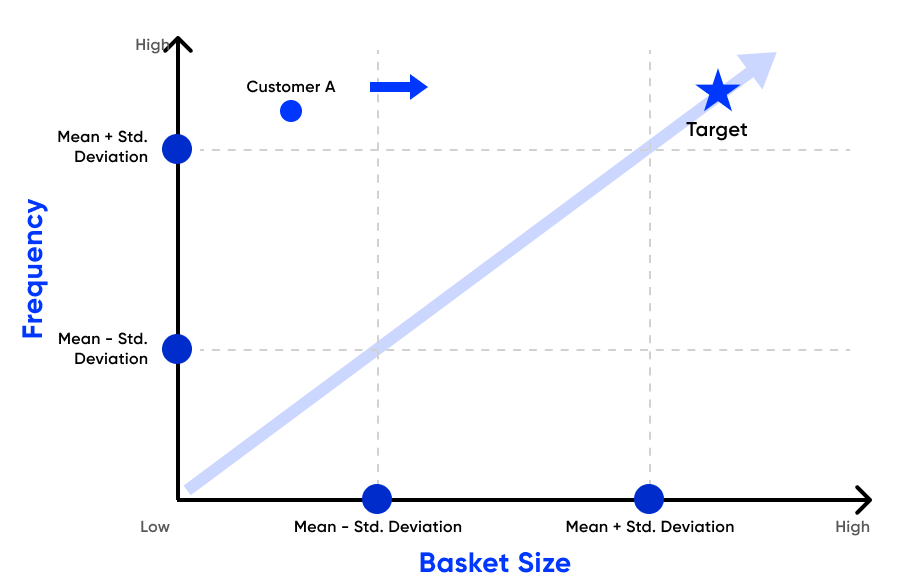

Once you have activated your customers in the merchant category mix model, the next step is to increase their basket size and transaction frequency. To get started, you can classify your customers by their average basket size and transaction frequency by creating nine subgroups as illustrated in the diagram below.

Figure 2: Nine-box credit card spending diagram

Subsequently, establish a campaign objective for each of the subgroups. For instance, suppose Customer A only uses your bank’s credit card for low-basket size purchases. In that case, your objective for this customer should be to encourage him to make higher basket-size purchases. To achieve this, you can focus on presenting interest-free installment campaigns, which are effective in high-basket-size sectors.

RANK YOUR CAMPAIGNS WITH A CUSTOMER-BASED DEEPENING STRATEGY IN MIND

After defining the campaign objective for the target customer, it is critical to rank campaigns that have the same objective. At this point, the maturity of your analytics capabilities becomes the hygiene factor as personalized campaign ranking plays a critical role in boosting campaign conversion rates. Your next-best campaign algorithm should be fed by a propensity model that includes shopping categories, reward type preferences, favorite brands, card limit utilization, card-specific offers, and other variables. This will allow you to rank campaigns that match your customers’ preferences and are more likely to result in higher conversion rates. Furthermore, your algorithm needs to be fed with customers’ daily activities to enable you to adjust your decisions (or “next-best actions”) on the fly.

In short, designing lean campaigns, creating a well-thought-out deepening strategy that takes into account your customers’ buying behavior, and harnessing the power of analytics are critical to managing extrinsic benefits intelligently. Although this article focuses on the extrinsic benefits layer of our framework, relying solely on extrinsic benefits is not sufficient to become your customers’ primary bank card. That is why our Credit Card Customer Relationship Enhancement Framework takes a holistic approach that involves enhancing your organization’s technological capabilities, fostering emotional bonds with your customers, and developing an effective communication approach. By focusing on these areas, you can create a lasting bond with your customers and become their go-to bank card.