Financial Services

Financial Services

- Insights

- Financial Services

- Case Study

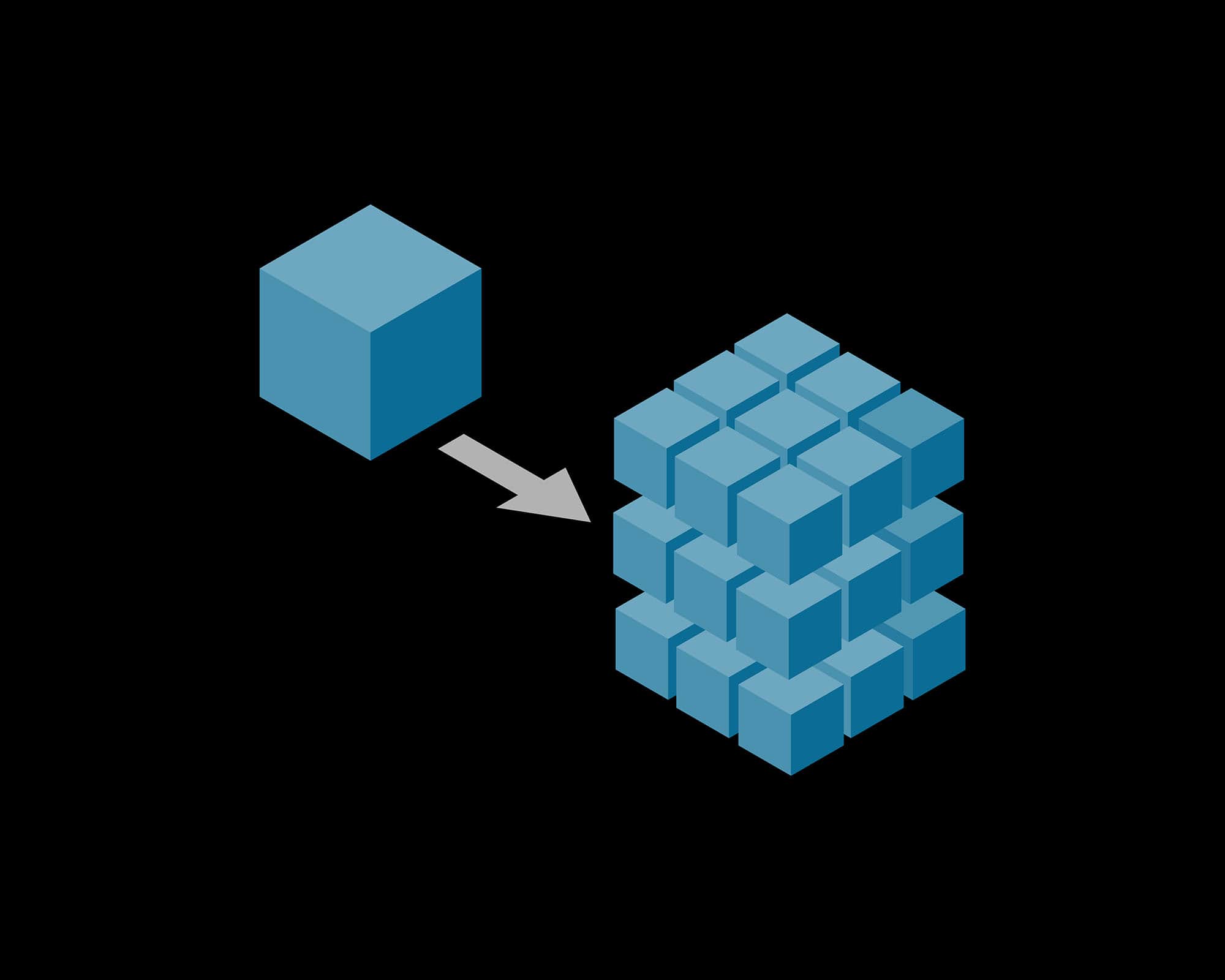

Delivering Next Generation Banking Architecture Program for a Major Private Bank

Automation brought about 18M € reduction in costs and saved 780 person-day.

Business Challenge

Our client was the second largest private bank in Turkey with subsidiaries in pension and life insurance, leasing, factoring, brokerage and asset management, besides international subsidiaries in Europe. They were highly dependent on their legacy mainframe. This was causing serious bottlenecks. Challenges and business objectives required the creation of a next generation banking architecture program. These objectives were:

– Deliver new business products faster

– Attract and retain talent in the organization

– Enable new talent to become productive in shorter amount of time

– Improve talent productivity (architects, developers, SREs)

– Accelerate innovation in the organization

– Modernize the core and manage obsolete technologies on legacy systems

– Reduce legacy systems complexity

– Reduce cost using distributed open environment

– Improve business operations through modern technology

How we helped?

Partnering with them in the Next-Gen Architecture Program since the beginning of their transformation journey, we provided guidance for the initial roadmap development and actively participated in development throughout this roadmap.

We involved various project teams which included a wide range of roles (PM, Architect, Developer, and Change Enablers):

– Assistance to Business Enablement Projects with our Program Management Expertise.

– Delivery of planned/ additional architecture features and components with the bank

– Applying next-gen architecture know-how, emerging technologies and abilities.

– Defining KPIs to track Development Issues and implementing improvements in the program, evolving Developer Experience to increase attrition

– Creating and developing an Open-Source Framework for the Platform

Results Achieved

– Gained 780 person-day reduction for employees with Automation Everywhere initiative in 2021

– 18M € cost reduction on Mainframe CPU (zCPU) usage & License Cost by the of 2021 and growing

– %5 MIPS Decommissioning, %12 backend TXN, %6 Frontend transformed to NextGen by 2021

– End-to-end Open-Source Systems Architecture & Framework that enabled Core Banking & Domain Applications

– Developer guides and technical documentations for architectural projects

– Bug and requirement management structure in complex and dependent teams

– Creation of Change Enablement Program within Next-Gen Architecture to assist Business Projects.

– Creation of Transformation Office and roadmap with the bank.

Explore deep-dive content to help you stay informed and up to date

Financial Services

Financial Services

Financial Services

Financial Services

From a Neglected Segment to a Major Trend: Creating User Experience for Corporate Customers

Read now Financial Services

Financial Services