Financial Services

Financial Services

- Insights

- Financial Services

- Article

Embedded Finance: The Dilemma for Incumbent Banks

What is embedded finance and what lies ahead for it?

Embedded finance has been revolutionizing the landscape of the banking industry, expanding the reach of financial services far beyond the traditional banking channels. This forward-thinking concept involves seamlessly integrating financial products and services into non-financial offerings, thereby merging previously discrete value chains of trade and financial services into a unified, interconnected one.

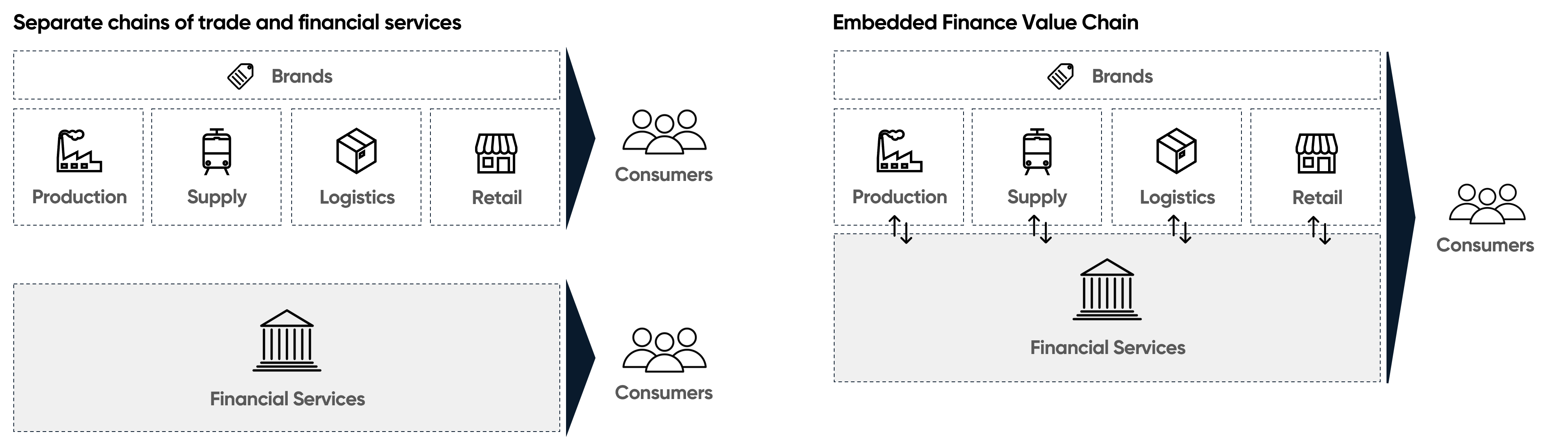

In the conventional worlds of trade and finance, products/services and financial services are delivered to customers through separate value chains. In the new paradigm, embedded finance injects banking products and services at various touchpoints along the value chain, precisely addressing customers’ financial needs at the exact moment they arise (as illustrated in Figure 1).

Figure 1: Previously Separate Value Chains of Finance and Trade, Now Embedded Finance Value Chain

This infusion, powered by banking-as-a-service capabilities, is transforming how financial services are accessed and utilized. A wide spectrum of non-bank entities, ranging from online marketplaces and brick-and-mortar retail stores to B2B solution providers, are enhancing the convenience of their offerings with the primary goal of elevating customer satisfaction and easing access to financial services. For instance, marketplaces like Amazon embed insurance offerings and buy-now-pay-later options for their customers. Retail giants like IKEA provide in-store financing for furniture purchases. Meanwhile, B2B platforms like Stripe and Shopify extend flexible working capital solutions to small businesses, all seamlessly integrating financial functionalities into their existing user experiences.

On a positive note, the embedded finance concept has moved beyond the Peak of Inflated Expectations stage, a key phase in Gartner’s Hype Cycle methodology [1]. This model serves as a guide for tracking the typical progression of emerging technologies, from initial excitement to eventual maturity. This state may indicate a promising future for embedded finance, as the concept is expected to reach maturity within 2 to 5 years.

In line with Gartner’s projection, a separate study conducted by Dealroom and ABM Amro anticipates significant growth in the global embedded finance market, potentially reaching an impressive $7 trillion by 2032, and representing a noteworthy 16% share of the global financial services market [2]. Currently, the largest segment within the embedded finance landscape is payments, lending, and insurance solutions. This trio collectively accounts for nearly 75% of the global embedded finance market and is expected to continue growing in the foreseeable future.

What has been working well so far?

According to our extensive research during client projects at DefineX, several embedded finance trials have demonstrated significant success, evident through their widespread adoption among distributors and customers. Let’s explore some leading use cases and examples catering to both corporate and individual customers.

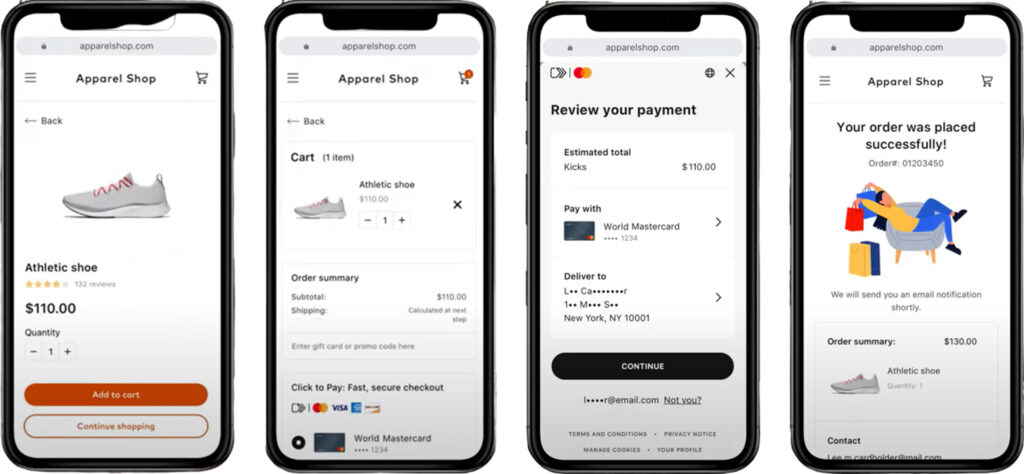

A- Express Checkout: Among the widely adopted embedded finance offerings, express checkout has gained substantial prominence, being distributed by a range of financial institutions, tech giants, and e-commerce platforms. Notable examples in this category include Click-to-Pay (a joint effort by Visa, Mastercard, American Express, and Discover), Amazon Pay, Google Pay, Apple Pay, PayPal One Touch, and Shop Pay. These solutions enable one-click checkout for customers, eliminating the need for redundant registrations on each merchant website and saving valuable time (see Figure 2). This streamlined and simple process not only enhances security but also convenience for end-users, ultimately boosting trade volume for SMEs.

Figure 2: Click-to-Pay Checkout Experience

B- Buy-Now-Pay-Later (BNPL): A growing trend in many countries is the use of BNPL solutions, which allows customers to split and stagger payments for their purchases over an extended period. These solutions are popular among unbanked customers and in situations where credit card installments are not an option due to regulatory constraints or the lack of support from the issuer and/or acquirer bank.

Well-known representatives of this concept include names such as Klarna, Affirm, and Afterpay. All these brands operate as marketplaces, curating thousands of brands on their platforms and offering loyalty programs to their customers.

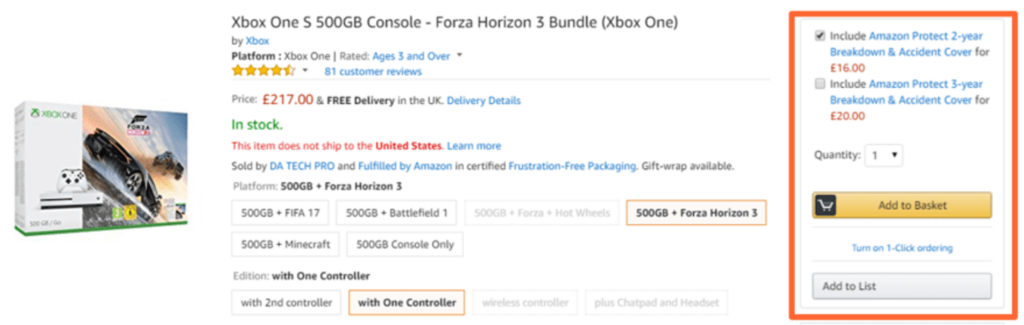

C- Extended Warranty: In a few industries, the integration of insurance solutions into the checkout process offers a seamless path to tailored coverage for buyers. This concept is finding application in industries such as retail, travel, and real estate, driven by the need to increase customer confidence and mitigate risks associated with transactions. Some examples of this practice include Amazon and MediaMarkt, which offer extended warranties for electronics (see Figure 3), Booking’s travel insurance for unexpected trip changes, and Airbnb’s Host Protection Insurance for property owners. These solutions address the specific needs of customers and increase their peace of mind during their transactions.

Figure 3: Amazon Protect Options During Checkout

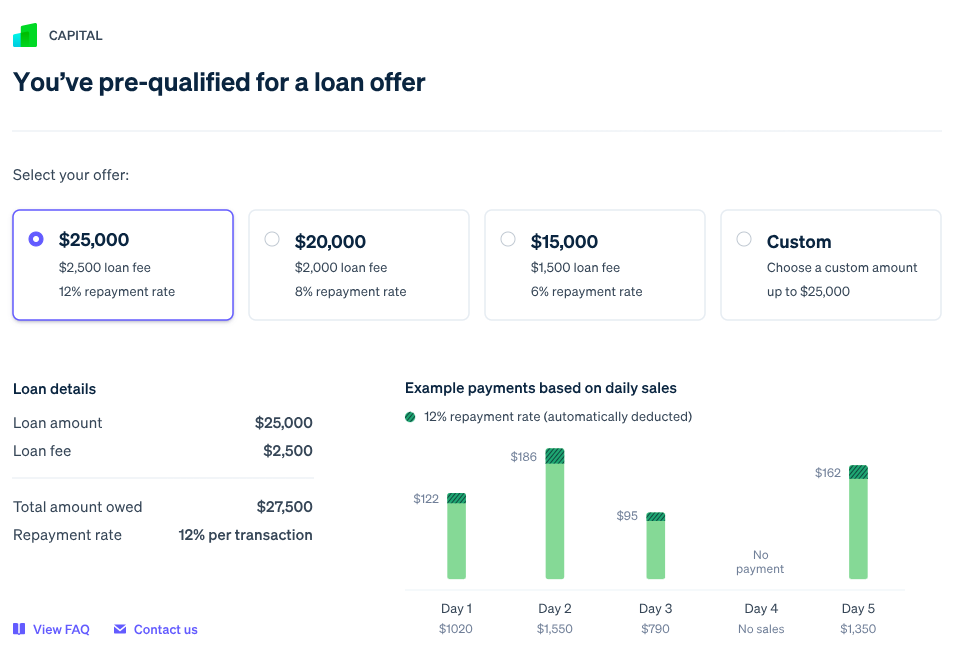

D- Flexible Working Capital: E-commerce and fintech platforms like Shopify, Stripe, Square, eBay, and Amazon have taken SME lending to another level through the introduction of flexible working capital solutions. These platforms provide loans to their merchant partners tailored to their unique financial circumstances, liberating them from the complexities of traditional credit lending processes in a world with restricted access to capital. Importantly, the utilization of these solutions does not impact merchants’ credit scores, granting them the flexibility to repay loans as a fixed percentage of their daily sales within a specified timeframe. This new approach empowers SMEs to navigate financial challenges with greater ease and adaptability. As seen in the Stripe Capital experience (Figure 4), merchant users who meet certain conditions can quickly use their pre-approved loans and repay them through deductions from their daily sales.

Figure 4: Stripe Capital with Flexible Repayment Options

In addition to these examples, other notable use cases are Know Your Customer (KYC) services for registering customers across various platforms, invoice financing for suppliers through accounting platforms, and instant payments to service providers in gig economy. While these offerings have proven their success and are validated by customers so far, the potential for innovation has no boundaries, given the ever-evolving nature of industries, regulatory changes, and emerging needs and opportunities.

What are the strategies for incumbent banks in this game?

It becomes evident that incumbent banks must navigate through unchartered territory. While banks are expected to retain their substantial customer base in the future, they will face competition from a wide range of players, including marketplaces, telecom companies, fintechs, and B2B solution providers, all vying to serve these customers.

In this changing landscape, there is an inherent risk for incumbent banks to lose some of their revenue to other players in the ecosystem. However, it is crucial to see the glass as half full, as this challenge presents an opportunity for banks to tap into new audiences, enhance customer loyalty, and create additional revenue streams. To achieve these opportunities, banks must not only understand their competition, but also embrace the collaboration with non-bank entities, positioning themselves advantageously in their interactions with customers.

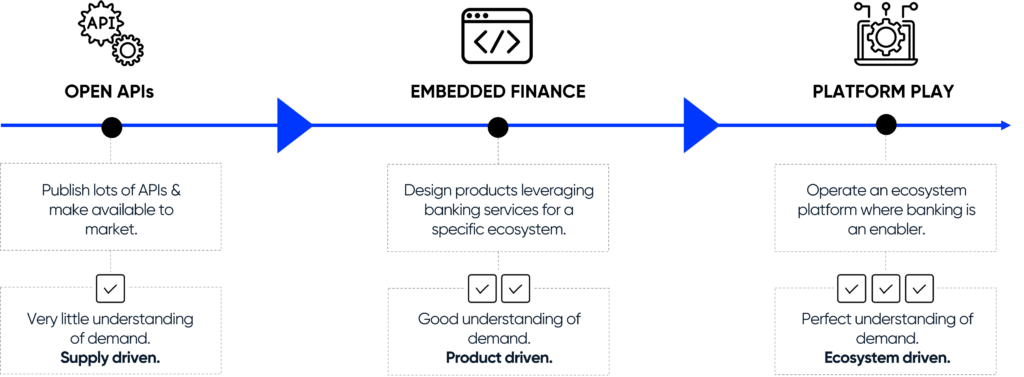

Figure 5 illustrates a spectrum of integration levels between the finance industry and the wider world of commerce, depicting the potential strategies for banks to adopt.

Figure 5: Alternative strategies for banks in embedded finance

Until a few years ago, providing an API Portal with relevant services was perceived as a significant step towards becoming the “Bank of the Future”. However, this model’s reliance on external providers to fulfill customer needs has left some market needs unmet. For this reason, instead of relying solely on open APIs, banks are now compelled to establish their presence where customers already exist, become an integral part of value chains in other business flows, and assume control over customer interaction points. This approach aligns ideally with banks’ ability to effectively serve customers with maximum reach by delivering the right value propositions through the right channels via integrated stakeholders.

A step forward in this journey leads to what we refer to as “Platform Play”. Through this strategic move, banks acquire or establish their own platforms with the capacity to actively discover customer needs and orchestrate the ecosystem. While this may not always be achievable, opportunities exist for banks to exert influence over certain ecosystems correlatively with their subsidiaries.

To simplify this conceptual discussion, let’s explore some comparative examples. In the open API model, a bank exposes its capabilities as APIs, including services like payments, consumer loans, and money transfers. Typically, this is done via an API portal that makes these services available to external parties. Embedded finance, on the other hand, goes a step further by bundling these APIs to build a complete solution like payment wallets, which offer various payment alternatives in a convenient way where customers already are. Global and local exemplars of such payment wallets include PayPal’s Venmo, Yapı Kredi’s WorldPay, and Garanti BBVA’s GarantiPay.

In the platform play, the bank operates an online marketplace and seamlessly integrate its financial products with non-financial services, forming an ecosystem where both sellers and buyers benefit from the bank’s convenient solutions. Notable examples of this concept can be observed in Pazarama and DBS marketplace, online marketplaces offered by Türkiye İş Bankası and Singapore’s DBS Bank, respectively, which effectively demonstrate the potential of this approach.

What are the challenges and solutions for banks in embedded finance space?

Embracing embedded finance comes with a unique set of challenges for incumbent banks. As the number of stakeholders involved in both competition and collaboration increases, the ability to adapt becomes a paramount concern, not only for banks but also for their partners engaged in the distribution of financial products within non-financial value chains.

Regulatory Compliance: The line between trade and finance is becoming increasingly transparent, triggering regulatory bodies to take new actions in auditing relevant industries. While ensuring compliance with existing regulations remains crucial, it is equally important to anticipate potential risks associated with the evolution of regulatory frameworks in the future.

Historically, banks have operated under more stringent regulations compared to other industries. Given this environment, a prudent approach for banks involves maintaining the flexibility to revert to their role of balance sheet providers should additional regulatory restrictions be imposed. Banks can achieve this by forming strategic partnerships with non-bank entities to deliver their solutions. According to McKinsey’s research, more than half of the revenues generated from embedded finance transactions go to the balance sheet providers [3]. This is still a good take for banks if regulations limit the game in certain areas.

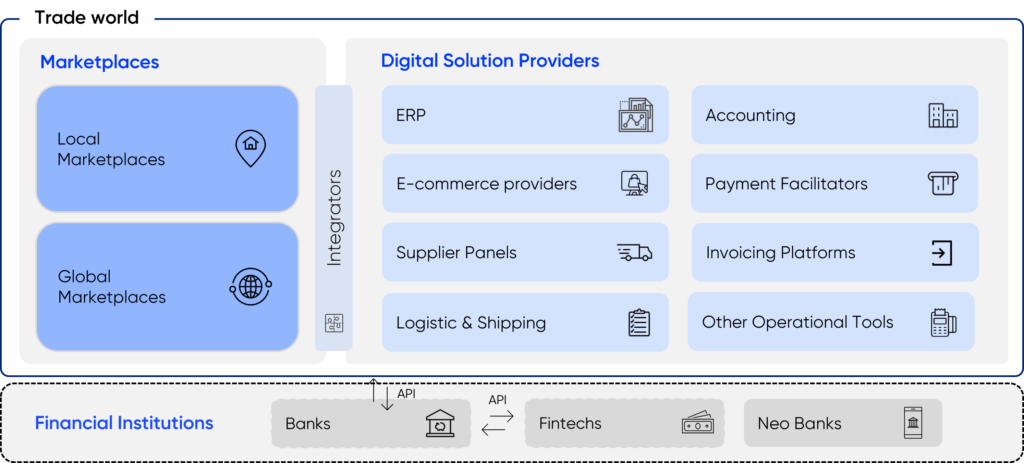

Competition in Commerce: As noted above, the rise of fintech and tech companies offering embedded finance services poses a significant threat to incumbent banks. Companies are managing their business and selling their products/services digitally via online marketplaces and digital solution providers, which have deeper insights into consumer behavior compared to traditional financial institutions, and they can capitalize on market gaps and develop financial solutions with agility. Below is an overview of this entire ecosystem, with banks and other financial institutions at the periphery of the picture (see Figure 6).

Figure 6: The Ecosystem of B2B Providers, Financial Institutions, and Online Marketplaces

While banks tend to focus solely on the needs and interests of their customers, disregarding the value proposition of other players in the ecosystem could lead to their exclusion from the world of commerce. Given that embedded finance solutions serve hidden customer needs in terms of user experience, the absence of banks may go unnoticed when these financial solutions are offered by other market players.

Based on our observations, distribution partners consider four critical factors when evaluating potential collaborations with banks:

1- Ensuring a seamless customer experience, which is evidently a top priority.

2- Offering a unique value proposition and exclusive benefits to their customers that are distinct from what regular bank customers receive.

3- Evaluating the financial burden, including the costs of integration/maintenance, as well as establishing a fair revenue sharing model with the bank.

4- Assessing the presence of a shared vision and the ease of operational collaboration with the bank in terms of flexibility and efficiency.

Operational Agility: Historically, banks have predominantly centered their efforts on their proprietary channels and products to engage with customers. Collaboration with other industries has often remained superficial, limited to marketing initiatives incentivizing customers to utilize financial products via partner platforms.

To truly become a disruptor in embedded finance, there is a need for dedicated product and technology teams. From the initial stages of opportunity discovery and regulatory compliance to the subsequent steps of product development and launch, agility emerges as the linchpin of success. With the continuously evolving regulations and changing customer needs, banks should be able to fully focus on the trade world and execute necessary product decisions quickly, free from the constraints of banks’ standard resource planning procedures and development masterplans.

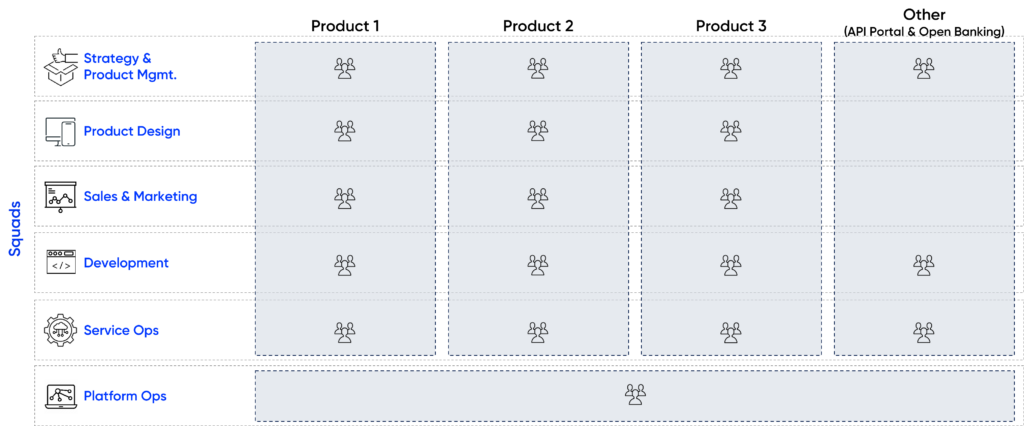

Figure 7 illustrates a sample model for the governance of new-generation banking initiatives. The strategy and product management squad assumes the role of product owner, responsible for discovering opportunities in the market, identifying the specific needs to be addressed, designing products to delight customers, and managing the product lifecycle from crave to grave. Other squads, including product design, sales, marketing, development, and service ops serve as contributors throughout the product’s lifecycle. They have the flexibility to collaborate across multiple products. However, we firmly believe that these squads maintain a strong focus on their respective products at all times.

Figure 7: The Organizational Schema for Embedded Finance

What is next?

The journey of embedded finance has proven to be transformative, offering a new paradigm for the financial industry. As the integration of financial services into non-financial channels continues, both customers and businesses are reaping the rewards of a more convenient, accessible, and seamless banking experience. Despite the challenges, incumbent banks must strive to transform into central figures in this new landscape. By embracing embedded finance, banks can elevate customer experiences and seize opportunities for new horizons in the commerce domain.

References

[1]: Hype Cycle for Digital Banking Transformation, Gartner, 2022

[2]: The rise of embedded finance, Dealroom.co and ABN-AMRO Ventures, 2022

[3]: Embedded finance: Who will lead the next payments revolution?, McKinsey, 2022

Explore deep-dive content to help you stay informed and up to date

Financial Services

Financial Services

Telecommunication

Telecommunication