Technology

Technology

- Insights

- Financial Services

- Article

Key Success Factors for Innovative Banking Products in Embedded Finance

A decade ago, banks made their introduction into the world of connected financial services through APIs, which was revolutionary for democratization of financial services data. However, as discussed In a previous DefineX Insights article [1], API world is bringing the risk of losing customer touchpoints and valuable data for banks, and the shift of some banking revenues to other industries.

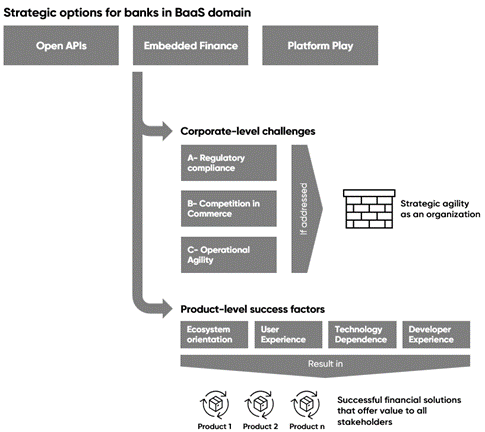

Considering various strategic options within BaaS domain, we believe banks should take the initiative to hold onto their customers by providing embedded finance solutions in relevant contexts. While aiming for this, the key challenges banks face on the embedded finance journey can be categorized into three main areas: continuous regulatory compliance, competition in the commerce world, and operational agility. While these challenges relate to corporate-level strategy, there are also product-level success factors that have been observed to have a significant impact on the success of financial solutions and are therefore considered crucial. These are:

- Ecosystem orientation: Delivering meaningful value to all stakeholders.

- User experience: Ease of use for end users.

- Technology dependency: Low dependency on technologies.

- Developer experience: Ease of integration for developers.

Figure 1: Strategic options, corporate-level challenges, product-level success factors

While the definition of success is abstract, the co-branded solution of BBVA Mexico and Uber is a great example [2]. In a market with a significantly low banked population, there was a need to establish a financial relationship between Uber and its drivers. With a debit card provided to drivers, they could collect their payments, access personal loans, and benefit from non-financial loyalty programs such as discounts on fuel or repairs

Success factors

It’s important to note that the success factors originated from real-world financial solutions of various companies in the financial services, technology, and e-commerce industries. However, they are also applicable to services outside the realm of financial services. So, let’s dig a little deeper.

1- Ecosystem Orientation

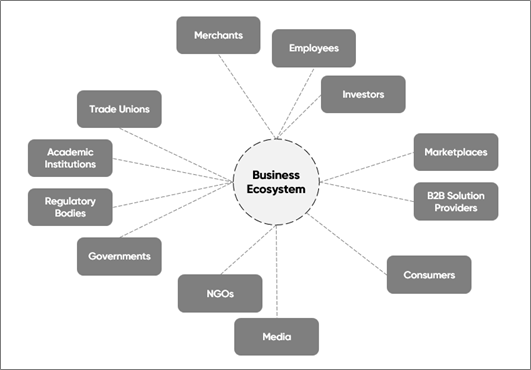

A common pitfall for product teams is the exclusive focus on end-user benefits during the product design phase. However, the business ecosystem consists of multiple stakeholders along the value chain. To drive market penetration successfully, it is essential to ensure that the value proposition resonates meaningfully with all stakeholders. These include consumers, merchants, employees, investors, marketplaces, solution providers, NGOs, media, governments, regulatory bodies, academic institutions, and trade unions.

Figure 2: Stakeholders in business ecosystem

A great example of ecosystem orientation is Google Pay’s strategy in India, which impacts the payment industry globally with some aspects of its working model.

In 2015, Google started working closely with the National Payment Corporation of India (NPCI), which is the country’s payment regulator authorized by the Reserve Bank of India. The goal was to create an interbank transfer system, which led to the deployment of the UPI network –an open and instant bank-to-bank transfer system that enabled the growth of open banking solutions in the country. In just three years, UPI’s annual transaction volume reached an amazing $ 230 billion equivalent to 10% of India’s GDP at the time [3]. This successful model was later adopted by many countries, including the US with the recently launched FedNow in 2023 [4, 5].

On the other hand, Google Pay also created crucial sub-benefits for businesses. Its mobile app features a marketplace that connects users with various service providers such as ridesharing, cleaning, etc., while Spot on Google Play platform connects job seekers with employers.

There were other initiatives too. Google partnered with Airtel to bring free Wi-Fi to villages, giving 10 million people access to the Internet for the first time in their lives [6]. Google also partnered with the government to create the “Digital Payment Abhiyan” program to create awareness about financial security and digital payments [7].

All these moves resulted in great success for the company. 67 million active users of Google Pay can make payments both online and in-store at more than 100 thousand retailers [8]. The company’s future plans for India involve sustaining the credit reach via connecting banks with Google’s audience, addressing the relatively low penetration of lending products compared to global and regional benchmarks [9].

2- User Experience

Google’s Ten Things Philosophy begins with one rule: “Focus on the user, and everything else will follow.” [10] This principle gains significance when you consider the substantial revenue loss – $1,420 trillion in 2020 – attributed to poor user experience, as reported by CareerFoundry’s study involving over 50 professionals at leading companies [11]. Interestingly, the investment required to fix user experience issues is relatively minimal, with Forrester claiming that every $1 invested in UX returns $100 [12].

At DefineX, we advocate for user experiences that demand minimal cognitive effort and deliver minimum disappointment. A crucial element of this philosophy is to ask only essential information from the user and simplify the processes. To illustrate this approach, we will look at a positive and a negative example.

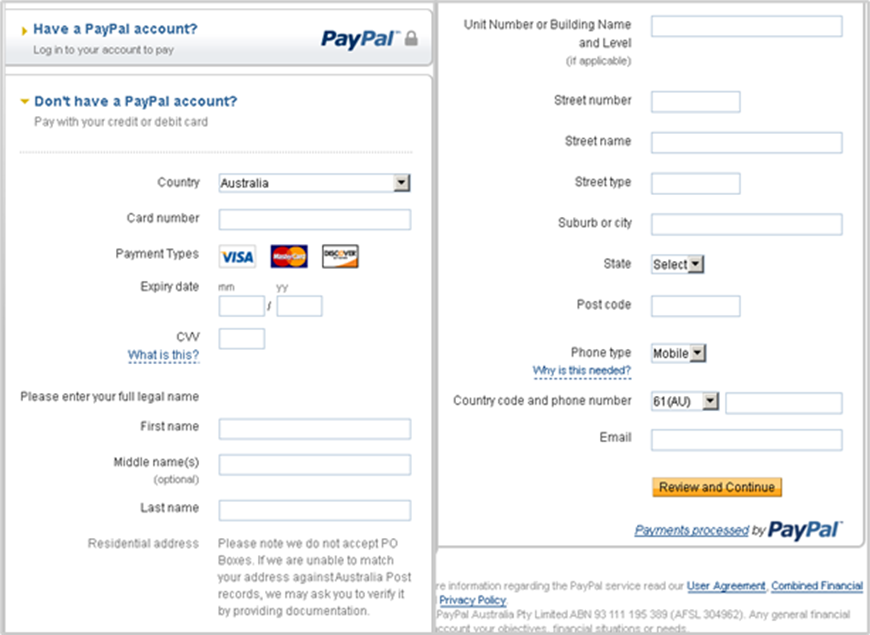

The negative example is PayPal’s express checkout product in its very early stages. The registration to the platform was time-consuming and confusing for users, which slowed the adoption. There were 19 different fields just to get payment and shipping information from customers, at least 6 of which were unnecessary and annoying to fill out. Of course, this complexity resulted in slower penetration and later evolved into a simpler experience.

Figure 3: PayPal’s registration experience in its early years

On the positive side, Shopify’s Shop Pay deserves credit for its great UX design. It is another express checkout solution available to merchant websites that simplifies the checkout step for users. Once a customer selects the Shop Pay option on “Merchant A” and proceeds, subsequent transactions on Merchant A or Merchant B do not require a new selection. The system intelligently recognizes the customer and seamlessly redirects them to the Shop Pay platform for the completion of the checkout. It is worth noting that, in terms of speed to complete the checkout and conversion rates, Shop Pay’s user experience exceeds benchmarks provided by various providers [13].

3- Technology Dependence

To enable market penetration, it is important that target audiences are not restrained by unprevailing technologies that pose accessibility challenges. As mentioned above in the case of Google, the company had made considerable efforts to bring Internet connectivity to the population.

We will analyze this point through two more examples.

When Apple Pay was first launched, its penetration was slow due to its NFC-based infrastructure, which was a rare technology at the time and required significant investment from merchants. Thus, the product had to wait some time before it became popular. Of course, this does not mean that Apple Pay was a failure, especially considering the volume of transactions it is processing today. But it does show an example of the negative impact of technology dependence, even if it was temporary.

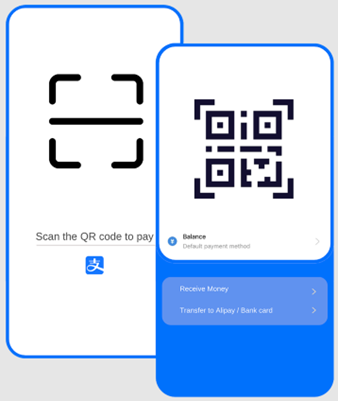

On a distant continent, AliPay had a simpler solution utilizing QR codes that work seamlessly on any mobile phone. Customers can effortlessly scan these codes at merchants to complete their payments, creating a perfect integration of physical stores and digital payments. AliPay’s model has proven its success, as the company has more than 1 billion active users, which is a payment method valid at more than 80 million stores around the world [14]. Their QR-based model is also common in many countries, including Türkiye. Here, banks have introduced payment wallets compatible with almost all POS devices in many stores, mirroring the success of AliPay’s accessible technology.

Figure 4: AliPay’s QR-based technology

4- Developer Experience

Recognizing that the backbone of successful solutions lies in the efforts of development teams, simplifying their work becomes a pivotal aspect. Despite the many factors that influence product success, there is one example worth mentioning where most of the success can be attributed to the developer experience.

Ranked as the second largest payment processing solution in the world, Stripe, had an annual transaction volume of $814 billion in 2022, which is approximately 14% of global retail e-commerce sales [15, 16]. Founded by two visionary entrepreneurs to address the need for payment processing infrastructure for businesses of all sizes, Stripe aimed to avoid the complicated integration processes of traditional banks and the restrictive commercial conditions of PayPal, the disruptor in the market at the time.

What set Stripe apart was its commitment to simplicity. It promised a seven-line code to connect to the Stripe API that would not need to be touched again for years. This ease of integration has created positive word-of-mouth among developers, leading to rapid company growth. According to Stackshare’s ongoing poll comparing Stripe with Adyen and Braintree, Stripe has more than 1500 upvotes, compared to Adyen and Braintree’s combined 137 upvotes as of November 2023 [17].

Conclusion:

There is no one-size-fits-all formula for financial product success in financial services or any other industry. Instead, it is clear that each business environment has its own unique dynamics that need to be addressed. Whether the goal is to expand the potential customer base, as in Google’s India example, or to implement excellent UX design, as demonstrated by Shop Pay, certain critical factors significantly influence the outcomes of an innovative product. One thing to keep in mind is that building connections between your product and users can be greatly facilitated by engaging with a variety of stakeholders.

References:

[1]: Embedded Finance: The dilemma for incumbent banks

[2]: Uber hails BBVA as it launches Uber Money

[3]: UPI Product Statistics by National Payments Corporation of India

[4]: India: Google offers advice to the Fed on FedNow

[5]: Federal Reserve announces that its new system for instant payments, the FedNow® Service

[6]: Airtel and Google partner to help grow India’s digital ecosystem

[7]: DSCI, MeitY and Google India join hands for ‘Digital Payment Abhiyan’

[8]: How Many People Use Google Pay in 2023?

[10]: Google’s Ten Things Philosophy

[11]: The Trillion Dollar UX Problem: A Comprehensive Guide to the ROI of UX

[12]: The Six Steps for Justifying Better UX

[13]: Shopify Checkout is the best-converting in the world. Here’s why

[14]: Over 10 Million Merchants Join Five Fortune Card Campaign on Alipay Platform

[15]: Stripe says in annual letter that it processed $817B in transactions in 2022

[16]: Retail e-commerce sales worldwide from 2014 to 2026

[17]: Stackshare’s comparison of Stripe, Adyen, and Braintree

Explore deep-dive content to help you stay informed and up to date

Technology

Technology

Financial Services

Financial Services