Technology

Technology

- Insights

- Financial Services

- Article

Mastering Credit Card Applications in the Digital Age

In the rapidly evolving digital landscape of mobile banking, the seamless delivery of core services like loans, credit cards, and money transfers is not just a convenience but a fundamental necessity. This digital shift promises a positive customer experience, reduced operational costs, heightened efficiency, and an expanded customer base for banks.

By the first three quarters of 2023, the number of credit card holders in Turkey soared to nearly 114 million, a significant jump from around 68 million in 2019. This dramatic growth underscores the growing importance of mobile channels in managing credit card services in this digital age. As customer behavior and expectations evolve, so too must the mobile channels that serve them, especially in the realm of credit card applications.

Interestingly, while it is expected that a significant portion of active mobile banking users will seek credit cards via mobile channels, a significant portion still opts for traditional branch or web applications. Nearly 50% of customers applying for credit cards via the web are already bank customers who actively utilize digital channels. This trend, common to many banks, is influenced by factors like low approval rates, limited card information, and the complexity of mobile processes. In the digital era, transforming customers into active mobile users and providing the preferred mobile channels present an opportunity for future progress.

The question arises: How can the credit card application process be optimized to accommodate the growing preference for mobile channels?

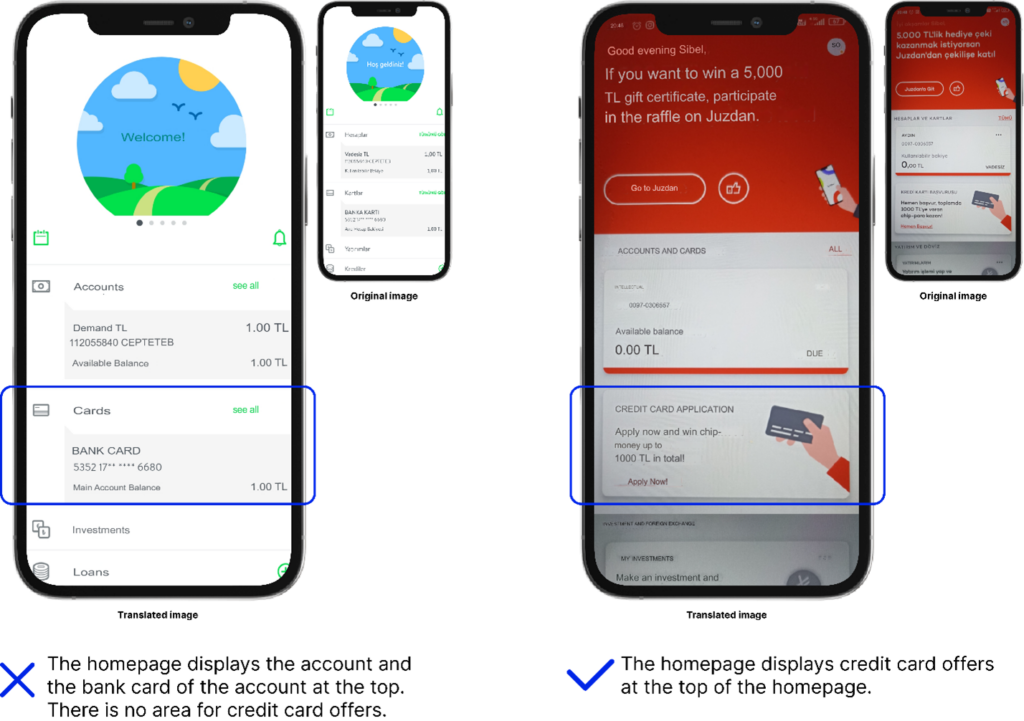

Before applying: Enrichment Injection Points

Strategically placing credit card offers in areas where potential mobile customers are active will attract their attention. These areas should be contextually related to credit card usage and present the right offer to the right audience at the right time. In our benchmark, these offers are strategically positioned on the drawer page, homepage, card details page, and transaction results screens. At DefineX, we have actively worked towards optimizing the placement of card offers on the drawer pages for numerous clients. These efforts have yielded remarkable results, including increases in daily credit card sales of up to 181%. Besides, credit card-related products (e.g., cash advance with installments, additional installments, etc.) can be positioned to serve as application incentives and referral points. Additionally, assigning and showing pre-approved limits to customers is critical to increase motivation to apply for credit cards. The visual representation of both negative and positive examples is shown in the image below:

During application: Highlight Value Proposition

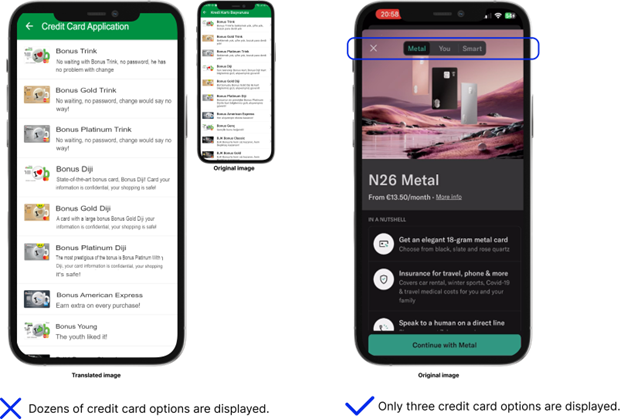

The proliferation of credit card options prompts a critical question: “Is there really a need to create so many credit card options?” In Turkey, for example, Akbank limits its offering to a select few like Axess and Wings, while Garanti BBVA presents about 30 different credit card choices. At this point, it’s crucial to reassess whether the value propositions and benefits of these cards are really different. After optimizing the number of card options available, it’s also essential to manage the card selection process correctly.

A critical observation is that customers often tend to abandon the application process during the credit card selection stage. Overloading them with a plethora of choices without adequate guidance leads to decision paralysis. Therefore, presenting credit card options in the mobile channel is an important consideration.

For one of our clients, the abandonment rate at the card selection stage reached nearly 80% when the value proposition was not distinctly highlighted. This underscores the need for clarity and personalization in card recommendations. Introducing credit cards in the mobile channel requires a presentation that is both comprehensive and guiding to prevent customers from leaving the mobile channel or application flow in search of information. Credit card promotions in the mobile channel should take an informative approach, allowing customers to compare bank card details with the minimum number of clicks and in the shortest amount of time.

Additionally, personalized card recommendations based on the customer’s profile, segment, and existing card ownership are essential to facilitate the decision-making process. Customers who successfully navigate the card selection and application flow not only contribute to a smoother process but also result in a higher number of completed applications. The accompanying images below illustrate both negative and positive examples:

During application: Seamless application process

Users who come to the mobile channel and select credit cards should be able to complete the process easily, quickly, and flawlessly once they enter the application flow. Forcing all customers into the same flow gives the impression that the bank lacks insight into its customers and fails to provide an optimal flow. Therefore, it is crucial to apply the right checks at the right points in the credit card application flow, directing customers to specialized flows based on this assessment. It is important to optimize the information set at this point. While some banks require up to 15 different pieces of information for non- pre-approved credit card applications, others demand as much as 30. This discrepancy indicates that the application process could be significantly streamlined with a much shorter set of information, potentially increasing efficiency and user satisfaction. Users with up-to-date information should not be asked for information again. Unconfirmed information or information based on customer statements should be kept to a minimum, and previously approved contracts should not be displayed. As DefineX, we optimize this information by evaluating its prevalence and impact within the banking and industry context. This begins with establishing a benchmark through a set of questions. Each piece of information or question is then assigned a score based on its prevalence across other banks. Subsequently, discussions with bank teams are conducted to identify information and questions that may impact the application process or require confirmation, resulting in a secondary set of scores. Based on the assigned scores, a priority ranking is then created for the question set. As a result, we offer simplification recommendations by excluding questions or information with low priority ranks from the application flow.

In cases where approval is denied due to an insufficient sector limit (which is automatically verified by the Limit Control System), customers should be presented with actions to take to open the sector limit in a positive tone. In cases where manual control is necessary, if there is explanatory information for the customer or documents to be uploaded, this information should be provided. Additionally, users receiving such notifications can be incentivized with motivational offers.

After application: Instant Result and Tracking

Once the correct checks are performed at the right points, non-limit-impacting information should be displayed on the summary screen, providing an opportunity to review and obtain contract approvals. Should a customer who reaches the confirmation screen, receive approval with a low limit, information and instructions should be provided. Conversely, if the customer is rejected, a clear explanation of the reason for denial should be provided, along with guidance for any necessary actions.

Considering the industry’s low delivery and activation rates, for customers, whose cards are approved, informative messages and precise instructions should be presented for immediate use and tracking of the process until the card is delivered. The tracking interface should provide customers with detailed information such as application details, expected delivery times, and ideally, the flexibility to update these details. Recognizing the critical importance of timely card activation, we recommend that all cards are enabled for immediate use. A notable statistic from the first three quarters of 2023 in Turkey shows that 29% of domestic credit card transactions were made online, indicating a strong customer preference for digital cards over physical ones. This trend underscores the importance of offering instant digital card solutions in the application process.

Conclusion

By implementing these four approaches, the mobile channel can be prioritized for credit card applications. Also, this user-centric approach will increase customer satisfaction and expand the pool of credit card customers, helping the bank gain a competitive advantage. Once the application process is established, you should continue to collect user feedback for future design improvements. This iterative feedback loop forms the foundation of a continuous improvement cycle.

Explore deep-dive content to help you stay informed and up to date

Technology

Technology

Financial Services

Financial Services

For Banks, Excellence In Digital Sales Is Not As Unreachable As You Think

Read now Financial Services

Financial Services

Exploring Uncharted Waters for Digital Banking Ventures

Read now Financial Services

Financial Services