Technology

Technology

- Insights

- Financial Services

- Article

Revolutionizing Credit Cards: Tailored Solutions for Every Lifestyle

With 114 million credit cards in circulation in the Turkish market, it’s evident that consumers prefer to have multiple cards. On average, each person holds three credit cards, driven primarily by two key factors: the desire to benefit from higher credit card limits and the appeal of diverse rewards programs. Interestingly, these factors offer contrasting contributions to competitive advantage within the industry. As credit card limit allocation is highly dependent on an individual’s income and available limit capacity, it is unlikely to observe significant differences in limit allocations among banks unless there is an insufficient or rigorous approach to risk assessment. On the other hand, reward programs offered by banks are enriched and diversified to attract customers with unique needs and preferences.

This article examines the important role of product design in credit cards, which plays a significant role in customer acquisition. It focuses on avenues for innovation that appeal to a wider audience through personalization by the integration of digital capabilities.

Segmentation Strategy: Tailoring Credit Card Portfolios to Customer Needs

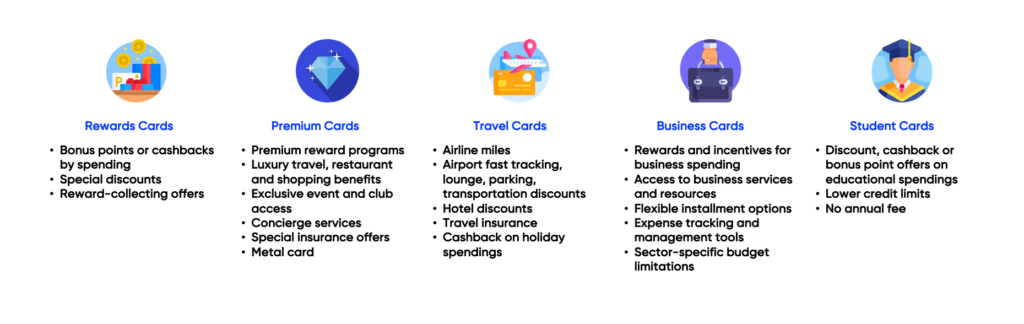

To ensure that the value proposition resonates with each customer, banks have developed their credit card portfolio strategy by segmenting customers based on demographics, lifestyle preferences, and behavioral patterns. By carefully analyzing these factors, along with audience size and profitability, banks have identified five mainstream credit card types that cater to the diverse needs and preferences by differentiating value propositions for each segment, as shown in the figure below.

Beyond credit card types, banks are tailoring their value propositions to meet the unique needs and preferences of their target audiences during customer acquisition. To extend their reach, banks are tapping into micro-segments such as pet owners, football fans, and nature lovers to build deeper relationships with specific consumer groups. In addition, secondary segmentation based on customers’ financial assets, spending habits, and credit limits is common, resulting in more diverse card types labeled as standard, plus, premium, black, silver, or gold. Payment providers like Mastercard, Visa, and American Express contribute to this multi-layered landscape by offering differentiated rewards programs and niche advantages that further enrich the Turkish credit card market.

In an effort to push the boundaries of innovation, banks have introduced digital cards with propositions of enhanced security, instant online shopping, and convenient QR payments. Through all these initiatives, credit cards have transcended their traditional role and evolved into powerful brand symbols synonymous with added value and customer centricity.

The Paradox of Choice: Navigating Through a Sea of Credit Card Options

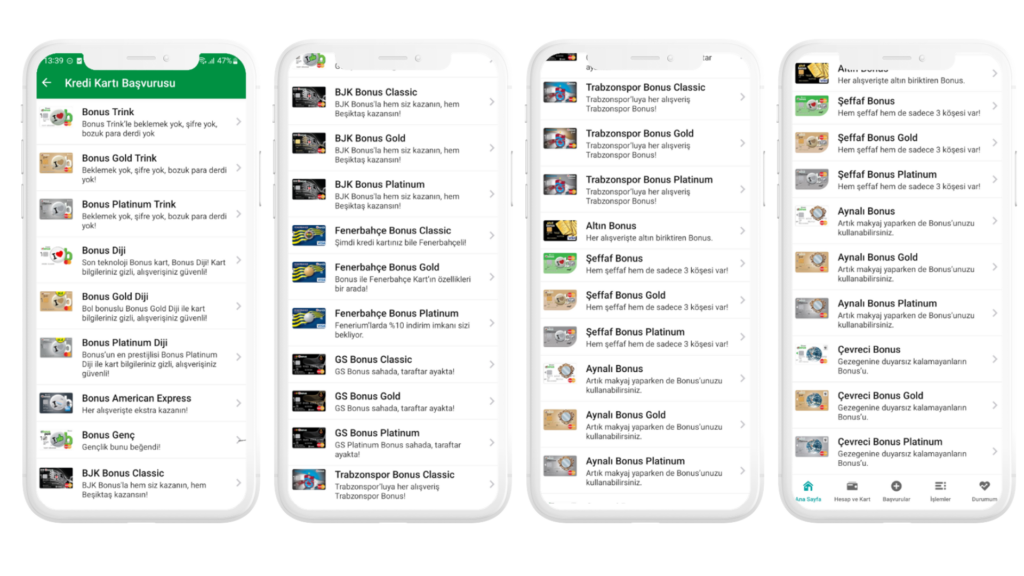

The wide variety of credit card types offered by different banks, and even within the same bank, presents customers with a plethora of reward structures, ranging from enticing bonuses to exclusive travel benefits. However, this abundance through a credit card purchasing journey often creates friction in the user experience rather than serving as a competitive advantage, especially in mobile applications.

Increased time spent.

Increased time spent.

As the number of credit cards rises, customers are required to click more frequently and spend longer periods browsing to explore their choices thoroughly. If the average time spent in this step is greater than the estimated time, it indicates that customers are looking for additional information to make informed decisions.

Increased cognitive load.

Increased cognitive load.

During the decision-making process, customers are obliged to analyze and compare the myriad of card options available, considering factors such as rewards, benefits, fees, and terms, in order to intelligently select the card that best suits their individual needs and preferences.

Drop-out at the purchasing phase.

Drop-out at the purchasing phase.

Due to the limited space and design constraints of mobile channels, banking applications often lack the information and guidance necessary for customers to make informed decisions during the credit card selection process. Some apps simply list credit cards without properly explaining their features and benefits, resulting in alarming bounce rates on the card selection page (in some cases, as DefineX, we have seen bounce rates as high as %62). The unmet need for decision support within apps forces customers to seek information from alternative channels like the Web, call centers, or branch offices. This redirection disrupts the user journey and can lead to a loss of potential customers.

For instance, scrolling through four pages of credit card options, as in Garanti’s mobile app, adds another layer of complexity to the user experience. This extensive scrolling exacerbates the challenge of finding the right credit card in a sea of options, potentially overwhelming users and discouraging them from completing the selection process.

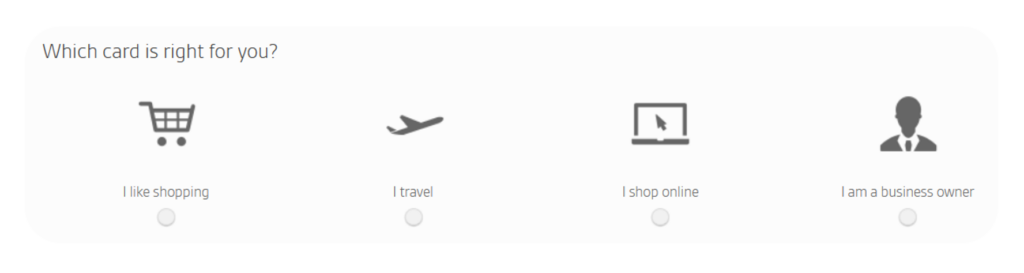

A seamless service design in credit card selection is necessary to eliminate the risks identified earlier. Akbank sets a noteworthy example with its single-choice questionnaire on its credit card website, which simplifies the process by matching options based on customer preferences.

While the decision-making process can be facilitated through the use of service design skills, there is another challenge to consider due to diversification through segmentation.

Imagine yourself as a customer, navigating through the sheer number of credit card options.

Everyone wears multiple hats in life, each demanding a unique financial solution. Take, for instance, an entrepreneur who runs a business, occasionally travels for work, goes to the market to collect fresh finds, and buys school essentials online for their children. In such scenarios, the need for multiple credit cards tailored to distinct needs arises, resulting in heavier wallets and decision paralysis when choosing which card to use.

This challenge extends beyond conventional segments, encompassing diverse lifestyles such as sports lovers, gamers, musicians, or car enthusiasts. Failing to acknowledge the nuances of these segments can lead to a concentration in standard card volumes, whereas overestimating them can create an overwhelming array of choices for customers.

The customization of value propositions through customer segmentation, while valuable, falls short of a comprehensive understanding of human nature and the intricate interplay of various roles and preferences. A more holistic approach is needed to effectively address the evolving needs and lifestyles of the modern consumer.

Transforming product design from commodity structures to liberal frameworks through digital capabilities.

By introducing flexibility into commoditized structures, the digital landscape gives an opportunity to create personalized product value propositions. Among the many digital tools available, add-on features stand out as a preferred mechanism for enhancing product offerings, enabling a variety of combinations tailored to individual customer preferences. While extensively utilized in many industries such as technology, telecommunications, airlines, automotive and retail, the banking sector has yet to fully exploit this potential.

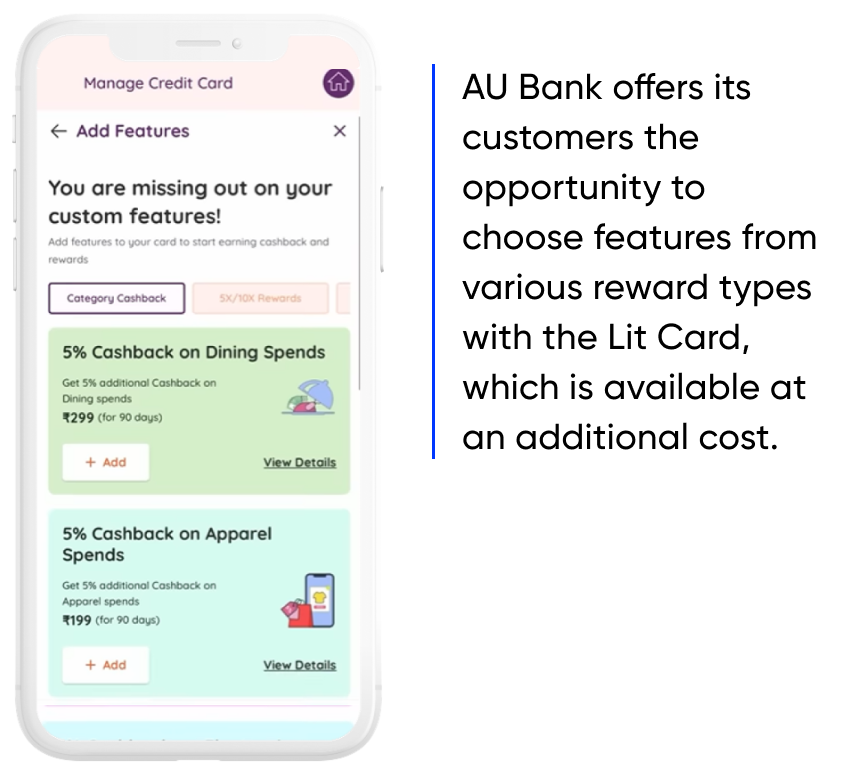

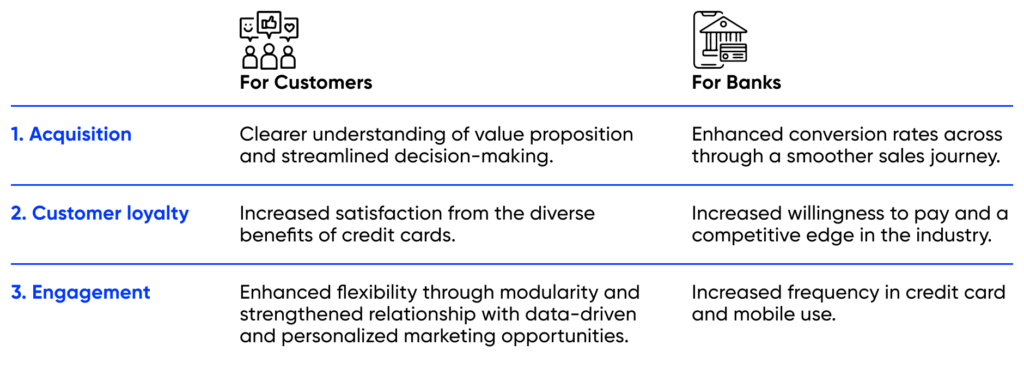

In the global landscape, numerous banks optimize their rewards systems based on the most common spending categories. However, few provide the flexibility of add-on features that allow customers to customize their credit card benefits, as AU Bank does, as shown in the figure. This approach not only reduces cognitive load but also increases the willingness to pay for card rewards, driving revenue growth and prompting a shift in the traditional revenue generation model.

There is an untapped opportunity in the credit card market to integrate add-on features into the product design, moving away from the conventional approach of bundling value propositions with credit card products.

There can be one credit card for everyone.

Crafting personalized credit cards that offer unique value propositions with a seamless user experience is achievable through a holistic product design approach.

Here are 4 steps towards designing personalized credit cards while considering true customer needs.

Define fundamental characteristics

Begin by defining the fundamental characteristics that shape the identity of a credit card. This includes determining payment options (such as contactless or mobile payments), allocating credit limits based on individual profiles and financial capabilities, setting competitive interest rates, selecting network affiliations (Visa, Mastercard, etc.), ensuring minimum benefits for

cardholders, and establishing fee structures. These instruments have the potential to introduce considerable variations, yet their orchestration can occur behind the scenes to maintain simplicity for users.

Packaging the credit card with add-on features

Design an MVP for a modular rewards system, leveraging insights from customer data management. Form strategic partnerships to offer exclusive advantages in a variety of benefits or discounts. This can take the form of package structures, diversified reward types, lifestyles, or brands, and can be expanded with a range of modular add-on options.

Leverage digital capabilities for a seamless user experience

Harness digital capabilities to ensure that users can easily comprehend the features and benefits of the credit card without experiencing cognitive load. The best way is just to analyze and recommend what’s right for each customer.

Continuously refine features based on customer insights

By understanding customer spending patterns, rewarding performance and feedback, implement a feedback loop to continuously refine credit card features and product design, ensuring that the product remains relevant and valuable to customers over time.

Simultaneous planning for a smooth transition process for existing cardholders is also necessary. The transition from their previous credit cards to the new offering should be carried out without imposing any obligations on customers or causing any financial loss to the bank.

Beyond all measurable impacts, it’s not just about simplifying the process; it’s about transforming the very essence of banking convenience. Imagine the power of a credit card is not just a means of payment, but a reflection of who you are, a tailored companion on your life journey. Join us in embarking on a journey towards a new era of banking, one where customer centricity takes the lead.

Explore deep-dive content to help you stay informed and up to date

Technology

Technology