Financial Services

Financial Services

- Insights

- Financial Services

- Article

Which Path Should Financial Service Providers Follow to Make a Difference with Content Thought Leadership?

Investment instruments in the banking and finance sector emerge as significant assets, particularly in light of recent years’ high inflation rates, which has steered individuals towards these financial instruments. Information obtained from regulatory bodies confirms the substantial interest of investors in capital markets, money markets, private pension systems, and similar savings channels. The recent surge in transaction volumes, account numbers, and the number of investors with balances indicates a trend toward financialization within society. In the last year alone, the number of investors with balances in the Turkish market increased by 55%, reaching 11.6 million from 7.5 million [1]. With the emergence of new investors and evolving expectations of the existing investors, it has become increasingly crucial to extend investment services to the masses through digital innovation has become more crucial. In this context, four key areas deserve focus:

- Asset Variety: Offering a diverse range of investment instruments to meet the different preferences and risk appetites of investors ensures that investors have access to a broad portfolio of financial products. Additionally, offering unique assets that stand out in the sector can attract user attention and encourage investment.

- Customer-centric Portfolio Management: Designing investment portfolios tailored to the needs and goals of individual investors ensures personalized and effective asset management. This approach helps investors achieve their objectives and enhances their satisfaction.

- Human Integrated Digital Advisory: Combining human expertise with digital tools to offer comprehensive and accessible investment advice to a broader audience increases the effectiveness of financial advisory services. This combination helps investors make more informed and personalized decisions.

- Digital Thought Leadership Through Content: The primary objective of content strategies is to guide and influence the flow of information with expertise and authority in a specific area, creating a deep impact on the target audience. Strategic content can build trust, increase brand awareness, and meet investor needs. This article focuses on this topic and explores how financial service providers can leverage content to make a significant difference in reaching and engaging investors.

Meeting Investor Content Needs Across Platforms

In today’s digital age, this strategy has gained significance, coupled with increasing investor interest. Investors seek content for various reasons such as making informed investment decisions, learning about riskier products, staying informed about trends, and understanding future expectations. Many banks, brokerage firms, digital players, and insurance companies aiming to meet customer expectations employ this strategy to build trust, increase brand awareness, expand market share, and promote new products through timely communication.

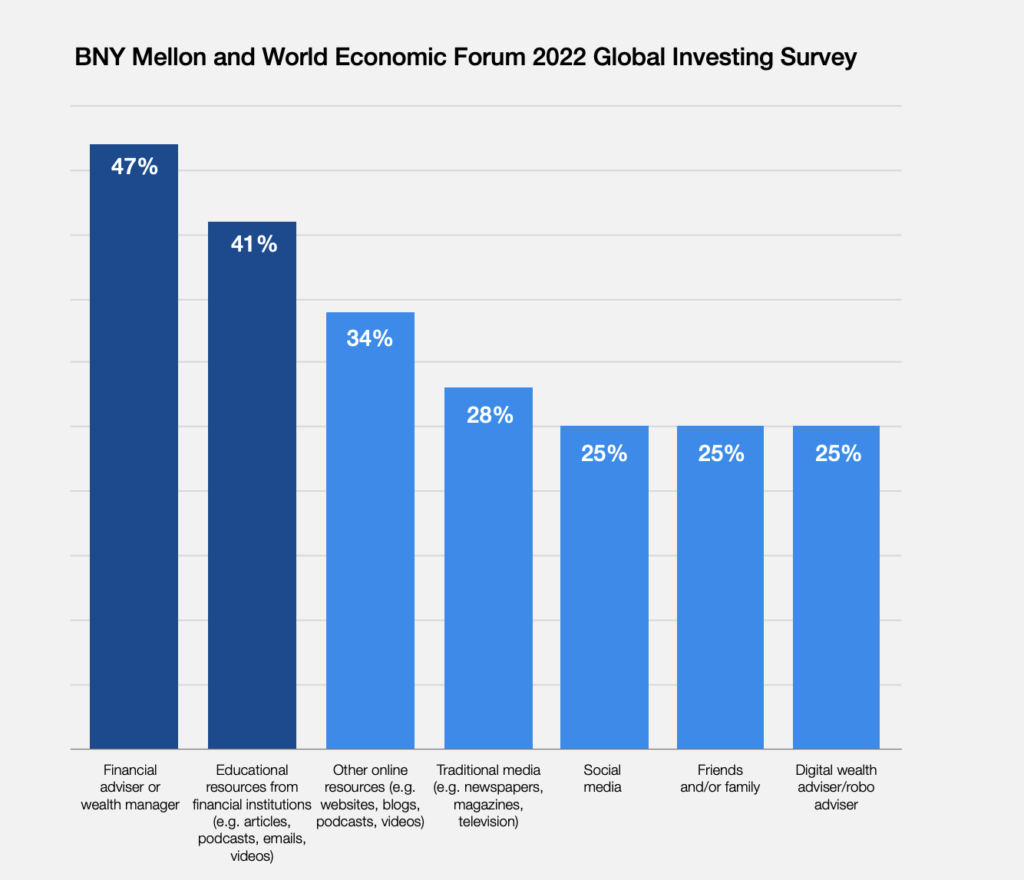

According to the BNY Mellon and World Economic Forum 2022 Global Investing survey, shown in the figure below, educational content produced by financial institutions emerges as a significant influencer of individual decisions, accounting for 41% of the respondents’ views [2]. Given the relatively limited access to individual financial advice in Turkey, the importance of reaching investors through educational content becomes even more pronounced.

Figure 1 – Key Drivers of Individual Financial Decisions

Today, investors seek to fulfill their content needs through various platforms. They actively search for investment-related content tailored to their preferences and needs through extensive research or recommendations. While financial websites and applications often fall short in providing comprehensive information, some users turn to alternative sources. For instance, Özgür Demirtaş, a finance professor with 6 million followers, provides informative content through a subscription service on X site. YouTube channels reach investors by presenting investment knowledge through short and long-form videos, with examples including the 206,000-subscriber Yatırım Finansman channel and the 268,000-subscriber Ekonomi Ekranı channel. Through these platforms, content creators, banks, and other digital investment channels continue to share information. However, when the content falls short of expectations, users seek alternative sources. So, what path should financial service providers take to make a difference with content thought leadership and reach users from a single source? Creating a strategic content plan is essential to making the difference.

Creating a Content Strategy

Content strategies come into play after decisions on targeted product increases and the segments to prioritize. Once sales strategies and objectives are determined, a series of steps – from setting content topics to analyzing performance – shape the trajectory of content creation and dissemination, as shown in Figure 2.

Figure 2. Content Strategy Creation Workflow

In the subsequent sections, we will explore these four key areas: Define Customers’ Monthly Routines & Set Growth Objectives, Determine Content Topics, Execute on Content Production & Distribution, and Determine Performance Measurement & Analysis. Each of these areas plays a crucial role in developing a robust content strategy that aligns with business objectives and meets the needs of the target audience.

- Define Your Target Customers and Set Growth Objectives

The first step in a digital thought leadership strategy is to define the monthly routines of your target audience and set growth objectives accordingly. Setting these objectives provides clarity and channels resources toward a unified purpose. It is essential to determine which customer segment will drive these objectives. Once the target audience is identified, it is crucial to define the moments of truth for these customers and deliver the necessary content at the right time when they need it.

When segmenting customers, it is important to consider several criteria: demographics, business, family and lifestyle, asset allocation (total assets, income, monthly spendings, credit loans), level of financial literacy and interest, investment motivations, investment profile and risk tolerance, investment background, and duration of investment and related life moments. Using these criteria, you can categorize customers into five groups according to their investment preferences: Very Low Risk, Low Risk, Moderate Risk, High Risk, and Very High Risk. Producing content tailored to these categories creates an effective communication strategy and increases customer loyalty by offering personalized content. Moreover, creating content that is appropriate for each customer’s level of knowledge ensures more effective results.

Leveraging data analytics and customer feedback can enhance the segmentation process and ensure that the content strategy remains dynamic and responsive to changing investor needs and market conditions. By continuously monitoring engagement metrics and adjusting content accordingly, financial service providers can maintain relevance and foster deeper connections with their audiences.

- Determine Content Topics

After defining the target audience, the next step is to determine the appropriate content topics. These topics should address the specific needs and expectations of each segment while remaining consistent with the overall strategy. In this context, content should be tailored to the five different risk categories to match each group’s risk profile.

For instance, providing stock market content to those inclined towards Very Low Risk products would not be suitable given their risk tolerance and investment preferences. Instead, content should focus on low-risk investment instruments such as money market funds, fixed-term deposits, private pension systems (PPS), and money market investment funds. This content should help these investors make more informed financial decisions by addressing their need for safe investment options.

Similarly, content should be tailored to the risk profiles of other segments. For those inclined towards low-risk products, information about bonds and high-quality corporate bonds can be provided. For those with a moderate risk preference, content on balanced portfolio strategies and a mix of stocks and bonds would be suitable. Those inclined towards High Risk and Very High Risk products should receive detailed and advanced information on stocks, growth-oriented funds, and innovative investment instruments.

Additionally, it is crucial to offer content that guides domestic stock investors on how to purchase stocks from international markets. Such content should cover topics like how international markets work, how to buy and sell stocks abroad, tax regulations, and how to use various stock exchange platforms. This information allows investors to diversify their portfolios and capitalize on global investment opportunities.

- Execute on Content Production & Distribution

This stage involves creating content that aligns with the established strategy and resonates with the target audience, and then publishing it on the appropriate platforms. Content production should be consistent with the identified content topics. It is essential that the content is high quality, engaging and informative to influence the target audience and build brand authority.

Content can be produced in a variety of formats, such as written content, infographics, videos, or podcasts, each with its own unique advantages and ways of engaging with the target audience. It is crucial to provide understandable texts and videos for each segment to ensure that information is presented in a language that everyone can understand. With adults attention spans dropping to 8 seconds, it is essential to produce content that is attention-grabbing, concise, and clear [3].

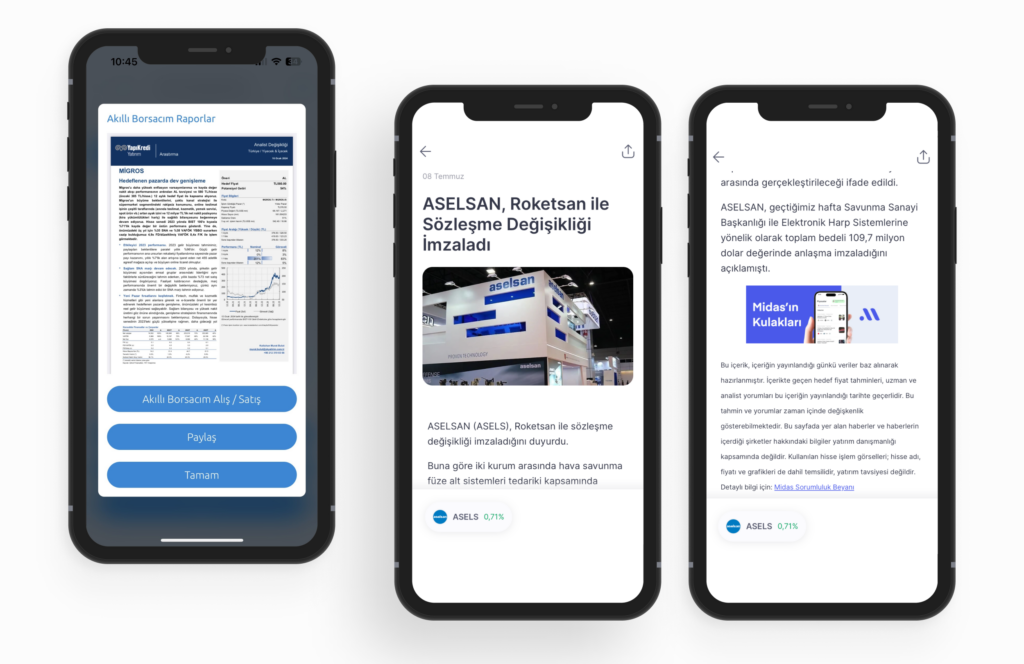

For example, the report in Figure 3, taken from Yapı Kredi’s Smart Investor Reports page, has a dense structure that requires extensive knowledge of the topic. In contrast, the example in Figure 4, taken from Midas’ “Midas’ın Kulakları” content, is presented in a simple and understandable manner without the use of different graphs or tables.

Figure 3. Yapı Kredi’s Smart Investor Reports Figure 4. Midas’ın Kulakları

The produced content should be distributed on platforms and at times that are most suitable for the target audience. Various channels can be utilized for content distribution, including social media platforms, blogs, email newsletters, and websites. Additionally, appropriate keywords and tags should be used to make the content more discoverable by the target audience.

- Determine Performance Measurement and Analysis Strategies

Performance measurement and analysis play a significant role in improving content quality, better understanding customer expectations, and taking action based on feedback. Key metrics to consider include reach, click-through rate (CTR), engagement rate, conversion rate, and time spent on content.

- Reach measures how many people were exposed to the content. Analyzing the number of visitors and views helps to identify which content is more engaging and which segments have a higher conversion rate.

- Click-through rate shows the level of interaction with the content.

- Engagement rate shows how well the content is resonating with the audience. This metric includes the number of likes, shares, and time spent viewing.

Conversion rate is essential if the content includes areas where customers can make purchases, such as subscription options. It helps determine the effectiveness of these areas in achieving their goals.

By analyzing these metrics, it becomes possible to determine which content is more important to which audiences, which content users find more engaging, and which segments have a high conversion rate. This analysis provides a roadmap for creating future content.

For instance, among the banks we serve at DefineX,

- Tier Two banks typically see content reach rates around 50%, whereas Tier One banks can see rates as high as 70%.

- When evaluating click-through rates, Tier Three banks average 0.15%, while Tier Two banks average around 0.35%.

- In terms of engagement rates, Tier One banks report around 0.25%, while Tier Three banks report around 0.10%.

These benchmarks are critical to understanding how content performs across different segments and shaping future content strategies accordingly.

Conclusion

In conclusion, digital thought leadership through content is an essential strategy for the banking and finance sector. Digital innovation is the primary strategy for reaching and engaging potential investors. Survey results show that educational content, such as emails and podcasts, influence 41% of individual investors’ investment decisions, underscoring the importance of digital content for financial institutions.

Investment firms that adopt effective content strategies can gain a competitive advantage in an environment saturated with both high-quality and low-quality content. By consistently delivering reliable and high-quality content, financial institutions can attract investors’ savings and establish a trusted and distinctive presence in the industry.

For those looking to refine their digital content strategies, consulting with experienced professionals can offer valuable insight and support. At DefineX, we are committed to helping organizations develop and implement effective content strategies that meet industry standards and drive success in the digital landscape.

[1]: https://www.vap.org.tr/?col=114

[2]: The Future of Capital Markets: Democratization of Retail Investing In collaboration with Accenture and BNY Mellon: INSIGHT REPORT AUGUST 2022

[3]: https://edition.cnn.com/2023/01/11/health/short-attention-span-ellness/index.html

Explore deep-dive content to help you stay informed and up to date

Financial Services

Financial Services

Financial Services

Financial Services

Build Long-Lasting Relationships with Your Credit Card Customers by Leveraging Extrinsic Benefits

Read now Financial Services

Financial Services