Financial Services

Financial Services

- Insights

- Financial Services

- Article

To be or not to be… a digital bank? That is the question

Creating a digital bank has been on the minds of investors in Turkey and beyond for some time. An investment in online banking appears to be promising. Is it really so? Do you know what this journey entails?

The latest regulatory amendments implemented by Turkey’s Banking Regulation and Supervision Agency have prepared the path for new banking business models. Among these new options, digital banking has received the most attention. Many investors, both domestic and foreign, are presently evaluating and contemplating investments in Digital Banking based on this new banking license model. Investment in digital banking is deemed appealing because the minimum capital requirements are very cheap compared to traditional models, and the Digital Bank ventures formed abroad to date have achieved extremely high valuations.

The economic model of digital banking is generally acknowledged to not factor in the expenses of setting up a branch network or the inefficiencies of antiquated technology infrastructures. Thus, digital banking may deliver the same banking services at cheaper prices and boast a stronger and more flexible structure than the conventional multi-branch banking model. Plus, the preliminary investment fees are more alluring. That’s the theory, at least. On the plus side, it’s enticing to say the least. However, things are not always what they seem.

This piece will evaluate the topic of investing in digital banking from many vantage points and provide a comprehensive discussion of the topic. To begin, I’ll cover the four most common errors in judgment made by financial backers. After that, I’ll go into detail on where you can find genuine openings. Finally, I’ll go over some of the other elements, like assembling a dream team, that are crucial to developing a successful strategy beyond just budgeting.

Four Assumptions that Could Lead You Astray

Digital banking has several benefits, including reducing operational expenses, but you are still establishing a bank. You must always keep in mind that the primary challenge in digital banking, like in any new enterprise, is to maximize the number of clients who wish to receive services from your bank and then retain these customers. Where exactly are these clients hiding out, and what makes your financial institution the best option for them? Let’s take a look at some of the “Misleading Assumptions” I’ve heard time and time again in my conversations with investors who are either currently venturing into the exciting world of creating a Digital Bank or are seriously considering doing so.

You should certainly bear in mind that the main issue in digital banking, like every new venture, is to maximize the number of customers who want to receive services from your bank and subsequently retain these customers.

Misleading Assumption 1: “If we stick to a low-price policy, we should do well”

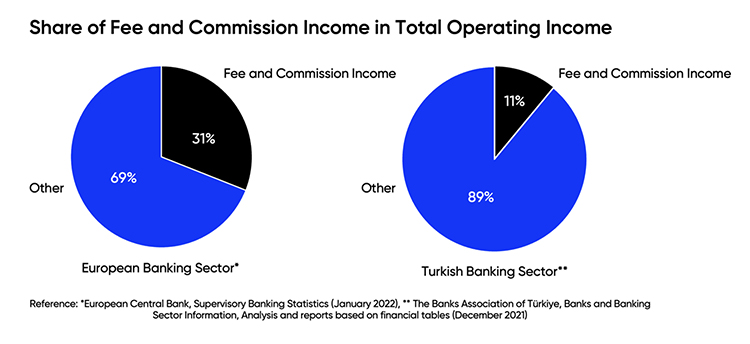

Competitive pricing for services like money transfers and payments is a common client acquisition tactic among international digital banking ventures. This business model capitalizes on the possibility afforded by the low operational expenses associated with digital banking in comparison to those of conventional banking, as a result of the high transaction fees and commissions charged in other nations. While this may work elsewhere, it does not appear to be a practical strategy for long-term success as a digital bank in Turkey. Both the percentage of total banking income that come from transaction fees and commissions are substantially smaller in Turkey. In some developed international markets, banking fees and commissions account for about half of a bank’s earnings. In Turkey, however, this figure is closer to 10–15%.

In addition, competition and regulations are already cutting into digital banking’s per-transaction income. However, the concept of commission-free transactions is only appropriate as a promotional model over a limited time frame. What do you plan to provide your low-price-acquisition-strategy customers within the future so that you can sustain your revenue stream? Are you sure that this model can create a breakthrough in Turkey?

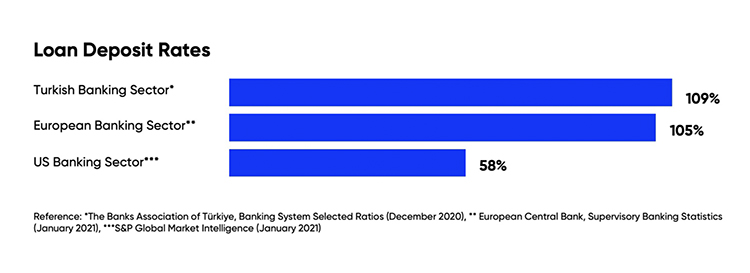

In Turkey, the primary sources of profit for banks stem from activities that are prompted by the interplay between making loans and taking in deposits. With the rise of digital banking, it’s simple to stimulate interest in lending money to others, but it’s more challenging to do the same for borrowing (increasing the deposits). That is to say, especially if you don’t gather demand and/or low-cost deposits, it’s very difficult to maintain a sustainable and competitive position (as banking professionals know, the loan-to-deposit ratio (LDR) is a problem that needs to be carefully handled).

While offering a low interest rate on loans is a tempting way to attract new customers to your Digital Bank, finding customers willing to provide the “low-cost deposit” so that you can maintain your competitive prices will be far more difficult. Banks that have been around for a long time and built their reputations on trust still see deposit collection as a top priority. Also, remember that Turkey is one of the countries where TRY savings are most often insufficient to match the demand for loans.

Gaining the confidence of customers who will entrust you with their deposits will be an uphill battle for your nascent digital bank. Everyone knows it’s pointless to say something like, “Let’s give high returns on deposits and attract the clients appropriately,” because you’ll have to make that promise soon, and the “high return on deposits/savings” will be the price of acquiring confidence. It is also another matter whether people will put their trust in a bank that offers extremely high rates of return on deposits. The journey is long, as you might guess.

I think we can all agree that the information I’ve presented thus far is the bare bones of the topic, on which most groups working on the issue would agree. That is, it is not feasible to operate under a fee and commission model that charges less, and it is also not conceivable to arrange a loan that has a low interest rate and a high yield deposit. As a result, it appears that a focus on price competition has not yielded desirable outcomes. You might become the focus of attention for customers if you implement these regulations, and you might even acquire a large customer base, but you’re probably not going to be profitable for the foreseeable future. The path you’re on may lead you to try to launch a bank that loses money and then to grow that model even though it’s not working. Consider if the customers you anticipated were the ones who are particularly price-conscious and always looking for the best deal. Keep in mind that in the end, you will convert into those whom you prefer to serve.

If your business concept isn’t likely to generate profits, how do you plan on attracting new investors to help it expand? Even investors in the venture ecosystem, who believe it is possible to write the tale of everything, won’t buy into a business built primarily on low prices. This model has been tried earlier in Turkey, and it did not have the desired effect.

Even the venture ecosystem investors, who advocate the view that it is possible to write the story of everything, will not buy a model that is essentially based on price competition.

Misleading Assumption 2: We will succeed by improving the customer experience.

Germany, where even opening an account is a problem, France, where purchasing investment products is a troublesome process, the United States, where meeting with a real banking professional requires an appointment, and many other countries with similar experiences have allowed digital bank initiatives to flourish.

New initiatives such as N26, Monzo, Atom Bank, Revolut, etc. have offered a real difference in terms of customer experience and came to the fore against the traditional banks that could not offer a feasible solution to these adverse experiences in the aforementioned countries. Innovative digital banking initiatives set an example on a global scale with their growth statistics thanks to the newly introduced regulations paving the way for them while conventional banks have been slow to embrace these superior service models.

How many Turkish banks, once the applicable law was enacted by the regulator, did not attempt to offer, or delayed offering innovative service experiences? Most Turkish banks welcome any regulatory improvement. However, Turkey lags behind Europe in adopting open banking legislation. If you want to “be the first to offer” a customer service that isn’t standard in the banking industry but has occurred to you for the first time, you’ll probably find that the law or regulations prohibiting such a service, in whole or in part, either directly or through oblique effects, will prevent you from doing so.

The vast majority of banks in Turkey are eager to seize any opportunity that regulation presents. However, the adoption of regulations on open banking in Turkey lags behind Europe.

A prominent example of this is the cryptocurrency asset-selling capabilities of the UK’s popular branchless bank, Revolut; without a doubt, the sales of cryptocurrency assets have significantly contributed to Revolut’s customer base and transaction volume. However, may we discuss the legality of such a service in Turkey? Raisin has developed a very basic, yet effective, over-bank platform model that maximizes the interest earned on deposits. In this arrangement, clients’ funds are transferred instantly from one bank to another within a country or even internationally with only their express permission required at each step. Is it not absolutely wonderful? Is this method of providing service legal in Turkey as it now stands?

Misleading Assumption 3: There are still many more services that the existing banks have not ever thought of, we will achieve success by implementing these innovative services.

While I’m sure most of you already know this, there’s something else I don’t want to gloss over: When compared to many other countries throughout the world, Turkey’s banking services are quite advanced, powerful, and functional. These services are already being offered competitively through digital channels. However, the business concepts on which many “neo-banks” are constructed might not find the expected reaction in Turkey, despite the fact that you should have the opportunity to examine examples of these types of institutions overseas, which I am sure would thrill you.

For instance, the “Buy now pay later” (BNPL) business model that has revolutionized the European consumer market and spawned unicorns has, in reality, been serving an identified customer in Turkey for years via means such as the many various payment plans available for credit card purchases. Let’s find out if letting Turkish consumers pay their bills next month instead of this one is enough of a perk to keep them as customers. You need to think about client behaviors first if you want to work on this model, and if we are close to this model in Turkey, you will. Consider the consequences of combining different models into a single one like BNPL. What would happen if, for instance, “overdraft similar credit accounts applied by traditional food stores” and “CGF (Credit Guarantee Fund)-like guarantee” were combined?

Numerous examples of this kind might be given. While it’s not quite true that every novel approach to customer service has already been implemented in Turkey, anyone who sets out with the goal of replicating the success of a foreign model in Turkey will face a steep and time-consuming learning curve.

Setting out with the idea of adapting an original example that you have seen abroad to Turkey as it is, will put you in a very difficult learning process.

When looking at Turkey’s advanced payment systems, for instance, it may not be able to have the predicted good impact created by businesses like Ali Pay, which swooped into China’s comparatively underdeveloped payment systems with innovations. To be clear, the problem is not whether or not to provide a “Soft Pos” and be compensated through “Square Code,” the talks of which I have heard and seen many times with great sadness. Customers will appreciate you if you improve their experience with a problem that has previously been solved, but it will be challenging to develop a successful digital bank on this premise alone.

As opposed to their foreign counterparts, models in Turkey that rely on the assistance of other banks or financial institutions are more likely to fail on a systemic level. Banks, in an instinctive attempt to stay competitive, will refuse to back such models until you reach the minimum necessary volume of customers. Existing players will always prefer physical buildings when it comes to the delivery of products and services that have reached the commodity stage. Therefore, as is the case in many nations around the world, it would be extremely challenging to have a significant impact on such models without the legislation making this form of cooperation essential.

In their current iteration, Open Banking and Banking Services Frameworks will only saturate tiny and light fintech businesses rather than producing opportunities large enough to feed a Digital Bank, unless the legislation further enforces these services. However, your needs for investment, framework, and employees would be very different.

Misleading Assumption 4: I will move my existing customers to my online bank because I am engaged in a financial activity that has broad appeal.

Imagine you have a large client base in an unrelated industry, and that the vast majority of these clients feel comfortable conducting business online. Is there a window of opportunity here? There is a chance, in fact, although it is not widespread in the financial services industry. You can rest easy knowing that Turkey will not be in need of any other money transfer services in the near future. The answer is yes, but only if your target market has difficulty gaining access to the financial services you offer as part of your core offerings, and you feel compelled to “integrate” these services into your service portfolio in order to present your consumers with a superior value proposition. If not, we’ll be back on the bumpy path we were on before.

E-commerce marketplaces are prime instances of this trend because they have recently launched only depending on their existing consumers to offer wallets and related financial services. Wallets/e-money institutions can only continue so long as the subsidies on the services they provide, which is primarily dependent on money transfer and payment services and is often operating at a loss.

It’s possible that service promises jammed into easily accessible services will only catch attention during specific promotional periods or as long as you “pay for it,” metaphorically speaking. Long-term, this concept shouldn’t look too appealing unless you’re trying to fool people with your valuations. Around top of that, the regulations may unexpectedly upset your “convenient” game plan that you have built on cross-selling to your existing clients, as we have seen as a result of the aforesaid revisions over the recent time.

Players who set out to attract customers outside of the traditional banking system also present a problem. You should be aware that many people in Turkey are still excluded from the financial system. Data research firm Landgeist used 2017 World Bank data to determine that over 30 percent of Turks over the age of 15 still do not have a bank account, translating to almost 25 million people. Many organizations have been racking their brains for years to figure out how to incorporate these people into the system.

This article glosses over the reality that these consumers are not a part of the system not because they cannot reach the bank, but because they had no need of the bank before now. To restate it more succinctly, our studies and research have shown that these individuals do not have a financial need for banking services. There are certain niche groups of customers that are not like this, but they are the minority. Credit risk assessment and allocation model innovation is still possible, but it requires access to relevant information and experience to be implemented successfully. Let me warn you now that the KKB score is not sufficient to justify bringing this idea to market.

I keep running into people who want to know if they’re missing out. The banking industry offers high-quality support at reasonable rates, but no openings remain? That’s not what I meant to say at all. You can sum up my point as follows: In Turkey, the competitive strategy predicated on cheap fees & commissions and a good digital client experience is no longer enough to stand apart. Customers who have used your current services are not lining up to switch over whenever you launch a digital bank.

In Turkey, the competitive strategy predicated on cheap fees & commissions and a good digital client experience is no longer enough to stand apart.

Exploring Unknown Territories for the Sake of Digital Banking Ventures

Both domestically in Turkey (where we have been working as a digital consultancy firm for many years) and globally, the issue of starting a digital banking business is a hot topic for investors. Earlier in this article, I pointed out a few of the tasty but erroneous assumptions that many investors are making. For instance, I argued that differentiating yourself only by offering low prices and providing a good digital consumer experience is no longer adequate. Customers today look beyond the availability of digital services and to the quality of those services when deciding which financial institutions to do business with.

Now, you may be wondering where exactly the possibilities are in the realm of online banking. Here I’ll go over the fundamental ideas that banks should be investigating in order to get ahead and stay ahead of the competition.

There are openings in the market wherever banks fall short in their attempts to cater to each and every one of their customers’ specific needs. For quite some time, our group has been examining this chasm. In this part, I will elaborate on a few possibilities by using concrete examples from Turkey’s entrepreneurship ecosystem.

The chances we’ll be discussing may seem esoteric for the largest banks, but even they may boost their brand recognition and enable for international expansion with the correct service. That is to say, digital banks exploring niche markets should prepare for growth beyond their home country.

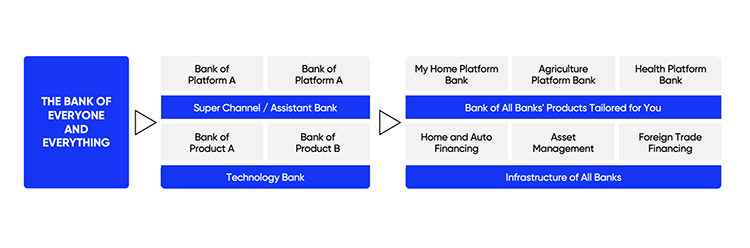

It’s a path toward creating customized digital banking services as opposed to generic banking institutions.

Be a Platform Bank: Broaden your services in select segments and ecosystems.

Target a specific subset of your consumer base based on shared interests, pain points, or other characteristics. Allow me to illustrate with something from Turkey. Unfortunately, there is a dearth of banking services that are horizontally oriented toward certain ecosystems, such as those populated by white-collar workers, farmers, retirees, small and medium-sized enterprises (SMEs) involved in international trade, real estate professionals, and so on. Existing banks, with a few notable exceptions, have significant barriers to expansion beyond the production of a small number of highly specialized services.

Some self-created ecosystems, like the agricultural one, or the retirement community one, may lack adequate digitalization or vision. Your digital bank’s value can be catalyzed by focusing on only a few of these use cases through an acquisition, partnership, or collaboration.

A digital banking contender interested in serving small and medium-sized enterprises (SMEs) might, for instance, acquire or form a partnership with a provider of accounting software that enjoys a high level of esteem among SMEs. Every participant in the ecosystem can benefit from your digital bank by building a business model that works for them. Therefore, it is crucial that you zero in on your area of focus and figure out how to generate common value and equitably distribute it.

Offer a comprehensive package in addition to the standard banking services already available in the target market. You can accomplish this by working with your business partners to build integrated services based on an understanding of the market’s specific requirements. If you want to target the agriculture industry, you should develop and release models that account for all the crucial services in that sector, including production, distribution, and oversight.

In order to make any real progress, you’ll need to create a digital platform that brings all of these elements together. Establishing a digital bank isn’t necessary but creating an ecosystem where your digital bank plays a central role is. The primary goal is to create and run a fully digital enterprise that incorporates all of the existing players in the relevant market. The shift from face-to-face interactions to digital platforms, where stakeholders like your bank, farmers, finance specialists, and agricultural product sellers may all interact in real time, is crucial.

Examples of well-conceived projects in this spirit include “Imece Mobil,” a mobile app catering to the needs of Turkish farmers. DefineX’s Maslak, an integrated API platform built over the course of several years, functions as a digital network connecting the ecosystem you envision.

You must address questions from their point of view for your targeted sector, such as:

- What does credit mean?

- How do you define insurance?

- How do you manage them?

- How about payments and what they include?

Finding solutions to these problems and developing new financial services as instruments inside a larger framework of generic ones is what we’re discussing here. I’d want to provide a concrete example to help you visualize these concepts.

Say you’re interested in studying the “Real Estate Ecosystem.” To further define this section, we will use the following:

- The term “mortgage” is used to describe the type of financing used to acquire property. In other cases, consumer debt for improvements and arrangements is represented by credit. A security deposit may be used as credit if there is a lease agreement.

- Insurance would be the mandatory protection for your property from disasters like fire, earthquake, and theft.

- Digitally setting up automatic payment options or deferments of subscriptions like electricity, water, gas, TV & streaming, and even lease payments is an integral part of cash management.

In terms of the services being provided, what does this breakdown mean? For the real estate industry, a powerful platform might provide:

- There are currently hundreds of thousands of prevalued homes on the market and on the rental market.

- In addition to other business partners, the platform can also include home appraisers and real estate brokers that help customers buy and sell properties.

- Your site provides a convenient meeting place for landlords and tenants to work out new lease terms or review existing ones. Perhaps they will even be able to evaluate one another.

- Services such as those of an electrician, plumber, painter, and so on can be made available on your platform for the ease of scheduling, paying for, and coordinating their services.

Therefore, your website’s front page is more likely to seem like that of a real estate sales/rental marketplace like “sahibinden.com” than it does that of a conventional bank. Or more accurately, sahibinden.com will found this kind of bank. Who knows, maybe you’ll replace the current ecosystem participants by offering free real estate advertising services while making all your money from banking services.

As you might expect, the payoff is tremendous if the right framework is put in place. You can serve as “a Platform Bank,” benefiting the local property market. You will be adding value and touching nearly every part of a person’s journey through the ecosystem if you accomplish this. Possibly, you’ll even branch out into other markets internationally.

So, what exactly are the most important variables? The ability to build equitable revenue sharing arrangements with business partners who represent their share of an ecosystem through in-depth familiarity with that ecosystem, catering to its demands, and abandoning an “all is mine” attitude. If this is the case, rather than creating all service offerings on your own, it is more efficient to digitally collect them from existing service providers and construct your new universe in the same way that a museum curator would. In our example, armut.com (a leading local services marketplace in Turkey) handles the electrical and plumbing problems, sahibinden.com handles real estate listings, and sigortam.net handles insurance (an insurance services marketplace in Turkey).

The most critical success factors: The ability to build equitable revenue sharing arrangements with business partners who represent their share of an ecosystem through in-depth familiarity with that ecosystem, catering to its demands, and abandoning an “all is mine” attitude.

Be a Super Channel: Offer Virtual Assistance and Marketplace When a bank controls the distribution channel, it can only offer products that cater to the customer base it has chosen to serve. This is analogous to a grocery store that exclusively stocks its own brand of goods and does not stock any competing labels. With very few exceptions, the banking business operates in much the same way everywhere. So, here’s a chance to greatly boost customer happiness by doing the following:

- Establish yourself as the go-to digital channel for customers to access affordable, convenient, and timely financial services. You should present the goods of all banks in a way that makes the consumer the focal point of the platform, even if you have your own items. Here, the consumer is prioritized over the product.

- If you put the customer first, you can top the list of preferred financial services. You should focus on finding the greatest financial products for your client, and let others handle the rest. This situation is very similar to online marketplaces.

- To expand your consumer base, have product-selling banks sign up as your clients. Make money by acting as a go-between for these deals. The most important and, maybe, challenging part of this is committing to the notion of offering the most advantageous product fitting your customers’ demands, independent of the source, rather than directing your customer to the product that will earn you the most cash.

Some portals are visible which have started off on a similar path, albeit in different industries. Markets in Turkey that compare prices among several vendors, including Cimri.com, enuygun.com, and hangikredi.com, are providing a valuable service to their customers by helping them find the “most advantageous” solution to their problems.

On the other hand, the client relationship in such establishments is limited to simple keyword-based queries. In this framework, the introduction of the virtual financial assistant allows for greater consumer understanding, the generation of insights from client data, and the presentation of previously unavailable possibilities.

It’s a good idea to offer customers the best deal possible when it comes to more conventional items like loans. On the other hand, traditional banking’s wealth management services, for example, can benefit greatly from digital capabilities, and this presents a significant opportunity. When you eliminate the obstacles customers face in gaining access to information and services, you’ll be able to capitalize on the resulting openings.

Advances like regulators extending the field for “open banking,” and advancements like providing freedom to the customer regarding the digital sharing and processing of their own data will benefit those that are building solutions to provide value to the client, rather than a banking product. These changes will also make banks in Turkey more nimble, encouraging others to place a premium on the enormous benefits to customers while opening up new revenue streams for those that give the best solutions to the market.

Be a Technology Bank: Provide a Common Infrastructure for Your Targeted Ecosystems. Nobody should assume they can design, develop, and run a fully functional digital banking system by themselves. While licensing, infrastructure, and operational expenses are lower than in traditional bank branches, the aforementioned areas won’t be able to amass a significant customer base quickly. In order to remain competitive, financial institutions should share infrastructures and licenses to cut costs in these key areas.

Despite the fact that “private infrastructures” do not appear to be an issue for banks serving a wide variety of consumers, it can be anticipated that that this will be the main obstacle for constructing new digital banks.

While traditional banking has had some precedents to follow, they have been slow to adopt common infrastructure prospects for fear of ceding market share to upstarts. The adoption of a standard point-of-sale system is a prime example of the benefits of shared infrastructure (Point of Sales). Contrarily, underperforming ATM networks are a classic case of what not to do. On the other hand, nearly every financial institution has its own proprietary core banking software, and with very few exceptions, this software is not shared with other financial institutions. It also possible to see to the same burdensome situation in the telecom industry where each player has to invest in similar kind of private infrastructures. Despite the fact that “private infrastructures” do not appear to be an issue for banks serving a wide variety of consumers, I anticipate that this will be the main obstacle for constructing new digital banks. There’s an obvious window of opportunity here, too.

To transform into a technology bank, you should provide your own basic banking infrastructure in the form of atomic services and outsource value-added services to the related ecosystem or ventures that specialize in super channels. Our “headless” banking infrastructure, built with innovative, cost-effective technology, is designed to simplify and streamline our customers’ financial lives.

We ought to develop in tandem with the most flourishing examples of interdependent ecosystems. Let’s establish ourselves as the digital banking business upon which all others are based. Some nations are adopting a technology-first strategy. Good examples include Mamboo, Finleap, and Solaris Bank. As one of the most tempting ways to expand internationally, it presents a tantalizing prospect. The improved platform banking outlook is having a particularly noticeable impact on the demand in the European and Middle Eastern markets.

If you want to gain an edge over the competition, you need to use the most advanced technology and implement a well-oiled machine. You’ll need solid IT teams and an integrated “product management” culture to tackle these obstacles head on. There appears to be a downward trend in such skills in Turkey, with no sign of an uptick in the foreseeable future. This may be the largest obstacle you face.

You’ll need solid IT teams and an integrated “product management” culture to tackle the obstacles that lie ahead.

What else do you need to know to be a digital banking ace?

Suppose, using one of the models we’ve discussed, you’ve found a promising area where there is actual demand from customers. I’m sure your strategy team has done the math on this, but if we’re going to keep things simple and go with a “rough account,” we run into this table.

Depending on the specifics of the digital banking license, the starting capital we’re discussing is between 1 and 2.5 billion TL. Current inflation rates, say 70%, mean that you need a 70% Return on Invested Capital (ROE) just to keep your purchasing power stable. Keeping your money safe from inflation will cost you money, since you will be required to pay taxes on all of your income. Indeed, not even a ROE of 70% will suffice. Let’s assume, for the sake of argument, that you require an approximate estimate to give a ROE of 100%.

As you can see, the scenario has ignored genuine profit in favor of hoping for it in future time periods. Let’s pretend we want to boost the “worth” of our online bank. I’ll spare you the tedious computation details and get right to the point: If you invest TRY 1 billion, you’ll need to attract and keep at least 500.000 active individual clients. It’s not a huge stretch to say that you could attract 2.5 times as many customers with a TRY 2.5 billion investment.

How much money would it take to bring in 500,000 new digital customers? If the complex mathematical models of the consulting industry overwhelm you, a “rough description” will do:

Personal loans, credit cards, and wage payment agreements are the most common financial items used as mediators in Turkey for the mass acquisition of individual clients. These are the essential and valid underlying mechanisms, and while you may come across variants of them in marketing tactics, they are all based on the same principles.

These building-block services are essential for expanding customer bases, and the novel Digital Banking models we discussed before won’t alter that fact. Until the underlying economic model of the market shifts, we know that these items will continue to reflect customers’ actual demands. However, the potential presented by the novel models I have detailed in this essay will help reduce the price of gaining and keeping customers. There are further studies that highlight the cost-saving effects of these novel approaches to client retention and acquisition, but I’d rather not get into those here.

Since up-to-date information on these novel models is not yet available, I am basing my predictions on historical market performance instead. Digital channels have a customer acquisition cost of about TRY 300–350 for a credit card customer and about TRY 150–200 for a consumer loan customer. I won’t get into the wage payment arrangements here because that would be even more expensive, but in the end, you’ll need it to get demand deposits.

The channel you choose, the level of optimization of the digital customer acquisition application (one of the most complex structures you have to install), your pricing policy, the competitive appetite of other market players, the economic dynamics of the country, and other similar factors will all have an impact on these numbers. To get a ballpark estimate, I’ve been using the most up-to-date numbers available.

If we don’t want to muddy the waters, let’s say that you need a budget of TRY 120-170 Million to acquire 500,000 clients, and that’s assuming you can design the most optimized customer acquisition application possible while also accounting for the average customer attrition rates of the industry. Moreover, be ready to reinvest one-third of that sum annually.

If you’ve done a quick estimate like this, your intuition may have convinced you that you can easily bring in that many new consumers. The problem of establishing and improving the infrastructure has now arisen. You are launching an online financial institution, and as such, your IT, Product Management, and Digital Sales and Marketing teams will be crucial to your success. Unsurprisingly, technological endeavors will constitute the bulk of your capital expenditures.

What exactly are these primary expenditures, though?

- US$3–4 million for the Primary Banking Application

- You are developing a digital frontend, or “Channel,” for the Platform’s Bank or Super Channel model. While the precise figure for this item will depend on the scale of your investment, we can estimate it to be somewhere in the range of USD 2-8 Million.

- The necessary hardware architecture to support this: Again, the quantity of clients is a key factor, but for the sake of argument let’s assume USD 1 Million.

Money can’t buy a solution to every problem.

You may expect the bulk of your initial technological investments will be around these levels the moment you switch on the motor. For the sake of argument, let’s assume that you were already prepared to undertake a commitment of this magnitude. Rather than focusing on the numbers, you should consider how you will supply these initiatives. Finding and building the talent pools to carry out these tasks and work on a technique that will deliver results is a subject about which very few people/teams in Turkey have experience, as we have indicated before. The following findings can be attained with minimal effort:

Compared to your forward-thinking setting, the majority of local core banking software is developed using antiquated technology and architecture. The part of you that wants to get these programs and get going right away will be at odds with the part of you that knows they aren’t compatible with your goals and will hold you captive within their constraints. Foreign core banking software is costly and lacking in features necessary to meet Turkish regulations. Whatever the case may be, your intuition will tell you not to use software that is entirely tied to foreign teams.

Teammates who claim things like “We can create the codes of the main banking program ourselves, it’s easy,” will also throw you off. You feel the need to ask a cruel question like, “How often have you created a banking-related software code, my dear friend?” but you restrain yourself out of goodwill. Your mind simply cannot be changed.

At the moment, I expect that many Digital Banking initiatives will fail because they are unable to find a solution to this technology supply challenge even before they get started. You aren’t out of luck entirely, though; several formidable groups are hard at work on the path to bringing these programs to fruition, and they’re growing closer and closer with each passing day. In the next 12 to 24 months, I anticipate that we will have at least some cutting-edge and adaptable core banking software upon which you may develop your vision. One of these groups may have you as their first customer if you are impatient and believe there is no time to wait. There are pros and cons to every first-client option. There will be a time when the benefits of having access to technology sooner may seem at odds with the challenges posed by having to figure out certain procedures first. Personally, I think this is a much better option than the previous, antiquated method.

Through our work, we learned that reverting to an earlier version of a project is an impossible task that will set your organization back in the race for innovation by at least one step. And then there’s the “Technical Debt” you incurred. I found my colleague Beltan Tönük’s book, Understanding the Technical Debt” to be quite informative on the topic. Every investor, CEO, and CTO who sets out on a venture like this should read this book, in my opinion.

Imagine you’ve cracked the “Core Banking” program. Now is the time to discuss the part about “Digital Channel.” Here’s a little experiment: If phrases like “channel software” and “omni-channel architecture” are commonplace in your office, then it’s likely that your team is heavily influenced by the IT department. I’m afraid to say it, but things are looking very dire right now. When phrases like “a platform model that will turn into a unicorn” are bandied about, though, it’s a sign that the marketing departments are in charge, despite the fact that the situation still appears dire. If the bulk of your staff is keen to discuss topics like “PDP, Compliance etc.” before discussing the company, don’t even bother getting started.

CREATING A WINNER TEAM

We’ve shortened the term “Your Digital Channel” to refer to what is more accurately called your “Product” in the context of a digital bank. This item Is the final outcome. Your strategy is embodied in the unique selling proposition you bring to the marketplace. Your clientele will use this to characterize you. A focal point of your efforts. The rationale of bringing another bank into existence. And… This product is mandatory and must be produced. If another person does the work, the result will be that person’s product. Like giving birth to a new human being. Although modern medicine and medical facilities have made conception, pregnancy, and childbirth safer and more manageable for expectant mothers, the reality remains that you, the expectant mother, will be the one to create the baby, bring it to term, and give birth to the child.

Exactly who is responsible for this then? The entire executive committee is responsible for this, but the CEO in particular. CEO, CPO, and CTO, respectively. This procedure relies heavily on the CPO in particular. From coming up with the idea for the product to taking it to market, s/he is the conductor of the entire orchestra. In my opinion, many thriving new businesses can be traced back to the vision and leadership of a CEO who is also skilled as a Product Manager. With any luck, the top executive of your company also has the experience and training necessary to serve as chief operating officer. Unfortunately, “Product Management” is one of the least familiar fields in Turkey. There aren’t many people who have the right kind of expertise and education to take on this position successfully.

Particularly the CPO is the most critical part of this process. S/he is the conductor of the journey beginning with creating the vision to launching the product.

Most people may probably anticipate the major causes of this: Because Turkey has always prioritized privilege-based economic models over creativity and inventiveness, this mechanism has remained weak. In addition, a select group of individuals possessing the expertise to successfully operate in this industry have already launched a startup and are running their own games. However, a number of smart individuals treat the topic as if it were only relevant to their own experiences, so they don’t bother to study and implement the best practices that the rest of the world has developed in this area. If necessary, I recommend having a plan in place for bringing in a foreign CPO. If I were in your shoes, I’d make sure the core members of my team had access to high-quality (sadly, there are too many phony versions) Product Management training from the get-go. The initial investment of time may cost you three months, but the long-term benefits will be worth it.

Taking into account the Digital Marketing and Sales Groups: To begin, keep in mind that Digital Marketing and Digital Sales are two distinct but related sets of competencies that make use of comparable tools but achieve different outcomes through distinct approaches. As with many other businesses formed in the digital era, your digital bank should be an “opinion leader” in the Platform/Ecosystem or value proposition it controls. In this respect, your thought leadership should also rule the internet in your target market. This necessitates the creation and distribution of high-quality, in-depth content that provides actual value to customers in the target market. Similar to real-world journalism. Simply said, it’s a variant of the same thing that conforms to the standards of the online world. A cosmos that is continually changing and is far more participatory. To market in this manner will be your primary focus. This is the working hypothesis of digital marketing departments. In order to be successful, your digital marketing team needs to be comprised of thought leaders who are also good at communicating their ideas.

Digital Bank, as with many businesses born in a digital environment, should be the “opinion leader” of the Platform/Ecosystem or value proposition it owns.

In contrast, your Digital Sales team needs to be well-versed in e-commerce fundamentals and adept at maximizing consumer access and conversion through strategic use of e-commerce-specific tools, processes, and technology. These two groups should sit next to one another and operate in tandem, but it’s important to keep in mind that they have quite distinct approaches to business, so they shouldn’t be merged. You can’t just hire a third party to fill in for team members on these squads. Having ensured that the intellectual capital has been fully realized, such techniques may be leveraged to provide some capacity flexibility.

The role of the CTO? The chief technology officer (CTO) is one of the most important people on the team. Traditionally, Turkey’s best qualified CTOs have worked in very large organizations. Because of the magnitude and complexity of the projects required by these organizations, as well as the widespread use of technology in them, they have cultivated leaders with a wealth of experience and expertise. It will be difficult to persuade such accomplished CTOs to take on such a risky endeavor. It’s also tough and expensive to attract these CTOs’ strong teams to collaborate with you on your Digital Bank journey.

If you’re having trouble finding solutions to these problems, you might want to consider hiring a chief technology officer from a startup instead. These CTOs are invaluable; they are experts at making magic happen quickly, nimbly, and on the cheap, but you should be aware that their methods and those of the traditional CTO are radically different. This decision will set the tone for the rest of your journey. By “course,” I mean not only the outcome of the process (whether successful or not), but also its speed, cost, and longevity. It’s possible that as your firm develops and as you seek out new investors, you’ll find that the CTO you started out with isn’t the same person you end up working with.

At every stage of the Digital Bank’s implementation, while the focus is on the product, the client, and the technology; risk management, capital sufficiency, and the regulatory oversight and burden are never considered. As a result, the business owner will likely be caught off guard by the extent of the implicit expenses here. Ultimately, you will be dealing with banking, which necessitates an experienced risk management team regardless of whether you are dealing with a digital bank or a bank with physical locations. So that you don’t get into problems in this highly regulated world, “goalkeepers” who play their own duties appropriately are necessary for the “let’s try and see,” “DIY,” “learn,” “break up,” and “try again” habits of the entrepreneurial world. If you can, however, locate a “goalkeeper who can also score a goal,” your newly assembled squad will be unbeatable.

Other topics I meant to cover here but will have to save for another time are: The conceptualization, development, and commercialization of the Digital Bank service/product. Potential stumbling blocks you’ll face throughout these procedures. How to find the right people, and how to put together a winning squad. How to create a workable company plan and a convincing business case. Methods for gaining new clients. Methods for carrying out market analysis. Rather of implementing a black box digital banking structure, it is crucial to consider how to incorporate the “human factor, that is, the banking professional” into the system, as trust is the most crucial aspect of banking.

Additionally, there is a setting where conventional banking has always considered the “dark side,” and here is where I anticipate the true “disruption” to occur. As you might guess, this is where DeFi takes place. Instead of being prejudiced and labeling this region the “dark side,” some forward-thinking banking professionals have begun attempts to “meet” and “connect” the new models outlined here with the classical ones. DeFi’s structure ushers in a new economic paradigm, one that further improves the cost-cutting benefits of digital banking while reducing overhead. That’s something I’ll address later, as it deserves its own post, if not more.

You need to match the client volume and sales/service strength of traditional banks that have already created enormous customer bases and a strong sales service network before they realize the innovation you are trying to achieve. This sums up the whole topic. Distribution and innovation’s symbiotically beneficial and detrimental effects on one another will be acted out. Consequently, seasoned players from the financial industry will also play the opposing side of this never-ending game. As a minimum, you can be sure this will not be an activity that will keep you alone and bored.

Explore deep-dive content to help you stay informed and up to date

Financial Services

Financial Services

Financial Services

Financial Services

From Mainframe to Microservices: A Success Story of Digital Transformation

Read now Financial Services

Financial Services