Technology

Technology

The Digital Workspace

Leverage the Human Factor in your digital channels

Most companies have digitized their services, but they've overlooked a crucial element: the Human Factor. Global trends like remote work, competition from digital players, trust issues on digital channels, and the metaverse concept demand a new solution. DefineX has redefined Digital Channels by integrating the Human Factor.

Contact Us

What needs fixing?

Digital banking without the human factor is a mobile ATM. If you place a machine in front of your customers instead of a bank, they will treat your bank as they treat their fridges.

- Money transfer limits

- Security controls

- Forced channel switches

- Wealth Management

- Mortgage

- Re-Financing

- International Trade

- Insurance

- Missing digital safety net

- Support for Special Core Groups

- Missing 3rd party actors – customers’ advisors

- Capacity frozen in silos

- Expert workforce missing at MoT

- Hard-to-manoeuvre prioritization and long deployment cycles

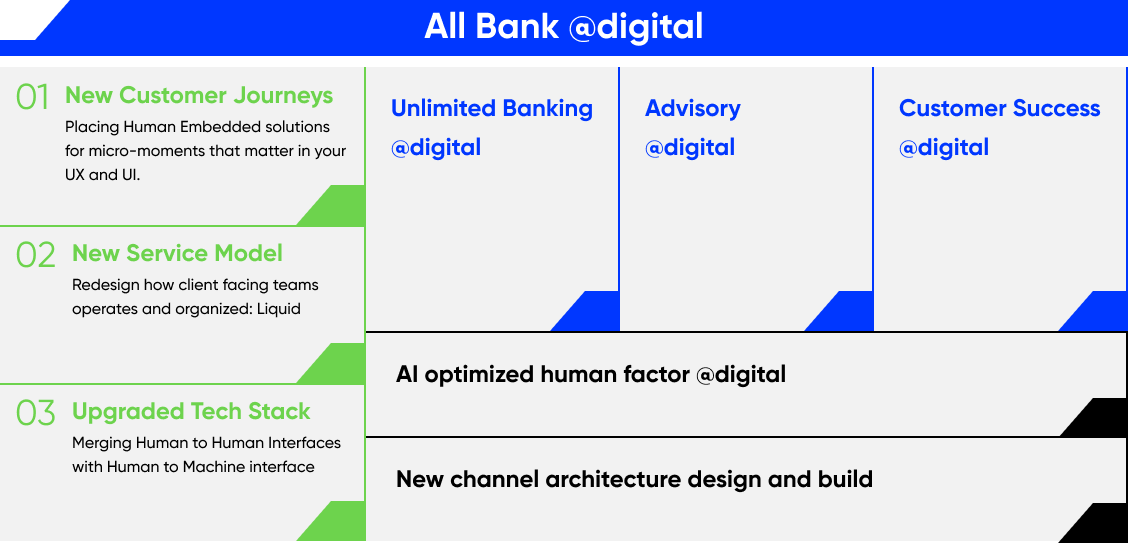

We leapfrog your bank to an All Bank @digital state.

Leapfrog Competition in Digital Play

Forget multichannel, omnichannel or all other names that describe a patchwork of channels. We design and build a new digital space where your employees, customers, and stakeholders meet and operate. This space is not your digital banking channel; this is your bank now existing digital with all human factors included.

Meet Our Experts