Financial Services

Financial Services

- Insights

- Financial Services

- Article

Elevating Banking Through Digital Workspace: Where Technology Meets Human Expertise

A banking experience where real-time support, empowered advisors, and effortless collaboration come together.

- Learn how AI and human expertise can work together to enhance customer interactions and operational efficiency.

- Uncover key issues like workforce mismanagement, neglected human advisory, and cost inefficiencies.

- See how technology, empowered teams, and strategic planning redefine customer journeys.

Digital banking has advanced rapidly, enabling customers to fulfill most of their needs online. Yet, despite continuous investments in technology, many micro-moments —instances where customers seek guidance, require support, or struggle to complete a transaction digitally—still require human intervention. DefineX has developed a new service model—Digital Workspace—to integrate the human factor into digital channels more effectively.

In this article, we revisit the challenges banks face in unifying human expertise with digital platforms, enriched with additional insights on technology architecture and organizational strategy.

From ATMs to the Digital Age: Are Branches Really Dead?

When ATMs and telephone banking first emerged, many assumed traditional branches were on the brink of extinction. As online banking surged, the same question reappeared. The COVID-19 crisis further accelerated digital banking, reinforcing the notion of branch obsolescence.

That said, bringing together fluid digital experiences and real-time human interaction can significantly enhance value. DefineX’s Digital Workspace tackles this challenge through a deep understanding of pain points, strategic technology solutions, and an empowered workforce model.

Three Core Challenges for Banks

1. Inefficient Workforce Management

Most banks employ a variety of teams—branch employees, customer representatives, subject-matter experts, field agents, and remote support staff. However, these roles are often poorly orchestrated and misaligned with actual customer demands. One branch may be overloaded while another has minimal workloads, leading to inconsistent service levels.A “liquid” workforce approach—flexible, adaptive, and agile—is essential. This allows banks to reallocate resources quickly, matching employee capabilities to market trends and customer requests in real time.

2. Neglected Human Advisory

Banks routinely focus on increasing digital interactions without fully understanding why customers abandon online journeys. While automation improves efficiency, customers still need advisory support at critical moments. The key is not placing human support everywhere, but rather identifying real pain points where customers struggle.

3. Poor Cost-to-Serve Management

A seamless customer journey experience has to be both digital and physical. It shouldn’t feel laborious to process a transaction quickly across channels. These costs and frustrations increase through insufficient system integrations, outdated branch tools and limited digital skills in offline settings.

By sharpening employee skill sets, streamlining processes, and aligning all channels to shared objectives, banks can manage operational costs effectively while providing a unified brand experience.

Leverage the Human Factor: A Win-Win for Customers and Bank Employees

From our experience working with banks, we see customers get frustrated when tasks that are easily solved by on-screen support in e-commerce are not equally intuitive in banking. Below are three common expectations:

“Why can’t I do it online?”

Some customers may be unable to access services online due to various reasons including restrictions, limitations or technical issues. A proactive digital system should be able to identify those situations where the customer may require human intervention. For instance when an ATM transfer limit prevents a customer from effecting a transaction, the customer should be able to be directed to a representative who can help the customer to complete the process digitally.

“I need advice.”

From complex investment products to segment-specific privileges, customers often seek professional guidance. This growing demand for personalization emphasizes the importance of integrating human touchpoints into digital journeys.

“What went wrong?”

When things go wrong, for instance, a foreign currency transfer is blocked or a card is delivered to the wrong address, it can be very annoying. These customers desire real-time support to resolve such problems without having to switch channels or even wait for a callback.

Insights from Branch Employees: The Call for an Empowered Workforce

The Digital Workspace approach isn’t just about customers. It also focuses on transforming the workforce to a new age to achieve better performance and career satisfaction.

- Time Constraints and Career Development

High volumes of queries, manual processes, and multiple communication channels overwhelm branch employees. They need continuous training and development to manage evolving products and digital technologies effectively. - Insufficient Digital Competencies

Complex, siloed processes slow down branch operations. File-sharing, digital signatures, screen sharing, and integrated communication platforms can streamline workflows. Employees must be properly trained to use digital tools, reducing errors and improving service quality.

When employees have the right skills and technology, they can handle any customer interaction from anywhere—boosting morale, efficiency, and customer satisfaction.

Building Trust in Digital Banking: The Critical Role of Human Interaction

The foundation of current banking relationships rests on digital trust. While advanced technologies increase convenience, human touch delivers empathy and reassurance. Through integrating human advisors with digital channels banks will be able to preserve customer trust while boosting loyalty and establishing lasting relationships that endure.

All Bank @Digital: Implementing the Digital Workspace

We work closely with our partners to define and implement a Digital Workspace strategy that enhances both customer experience and operational efficiency. From analyzing customer micro-moments to charting out the necessary technology stack and orchestrating workforce capabilities, we are with you every step of the way.

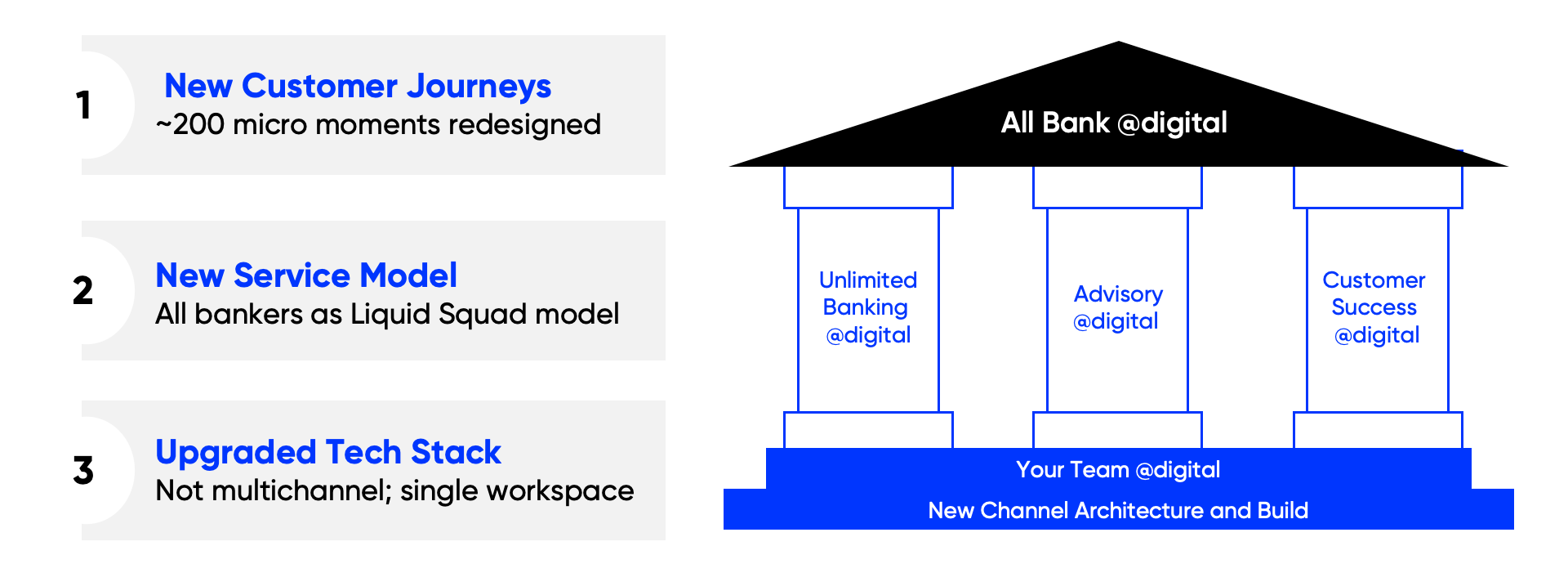

Figure 1-DefineX Digital Workspace Frameworks

Three Key Pillars of the Digital Workspace

- New Customer Journeys (“Micro-Moments”)

DefineX has identified over 200 micro-moments that call for human intervention. These typically fall into three categories:- Limited Banking (digital restrictions force offline solutions)

- Advisory (guidance and expert insights)

- Customer Success (prompt support and error resolution)

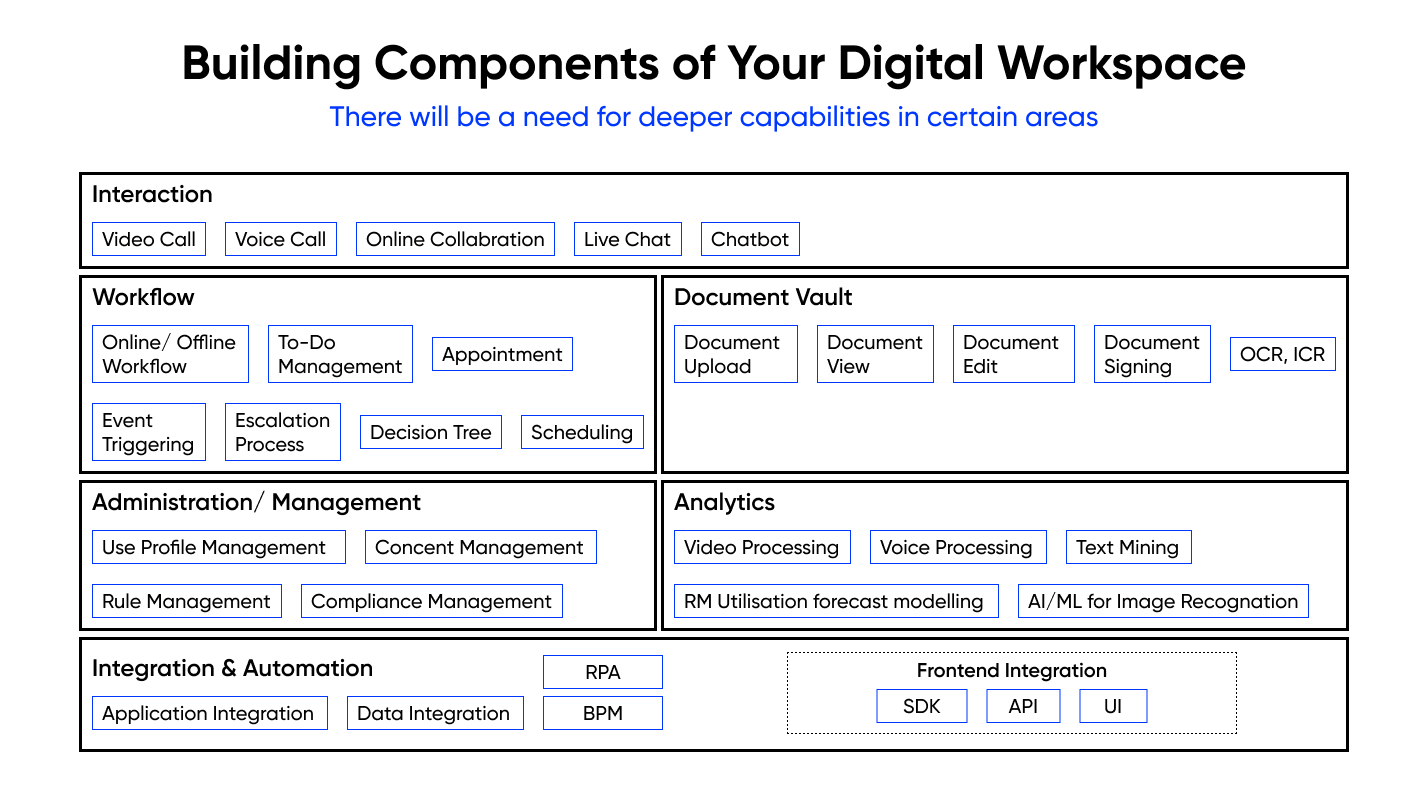

- Tech Stack (“Improved Channel Architecture”)

We start by evaluating the bank’s existing digital capabilities and identifying key gaps that hinder seamless integration between human and digital interactions. Through a structured gap analysis, we outline a technical transformation roadmap that prioritizes the necessary steps for an optimized Digital Workspace. This includes enhancing system architecture, improving real-time collaboration tools, and ensuring robust security measures. Key capabilities such as screen sharing, file uploads, and e-signatures are designed to facilitate smooth and secure interactions across all customer touchpoints. - Service Model (“Your Team @ Digital”)

We decide where, when, and how human support is triggered during each journey and determine the specialized skills required—whether it is product knowledge, sales authority, or back-office expertise.

Technology & Organizational Model: A Closer Look

Our research reveals how Digital Workspace technology needs to be structured for an ideal banking environment. In practice, many banks in Turkey still face significant gaps. One of the key challenges in building an effective Digital Workspace is ensuring seamless access to relevant customer data. Banks often struggle with holistic funnel management, fragmented communication infrastructure, inefficient workflows, and the absence of a unified customer view.

Real-World Application: Creating Service Blueprints

At DefineX, we have had the opportunity to work with top-tier regional banks to identify the exact technology requirements for a Digital Workspace. Our strategy includes developing service blueprints based on particular customer journeys. We compile this vast inventory of customer journeys across mass, affluent and corporate segments, to make sure that every blueprint is both technically robust and customer-centric.

The future of Digital Workspace is not about shifting everything to human advisors but rather about strategically blending AI-driven automation with human expertise. AI plays a crucial role in managing high-frequency, routine interactions, while human advisors focus on complex and high-value engagements. This hybrid approach is already shaping the evolution of digital banking and remains a key focus in defining future customer journeys.

A new organizational model ensures the right person is deployed for the right journey at the right time. Key questions include:

- Which team member supports a mass-segment customer versus an affluent or corporate client?

- What specialized business and technology skills does this individual need?

- How does talent management incorporate ongoing career growth and training?

Envisioning the Digital Workspace

One-Click Collaboration and Effortless Support

A Digital Workspace can serve as a new communication hub where customers and advisors connect instantly with one click. The goal: minimize channel-switching, prevent missed opportunities, and empower employees to resolve issues in real time. One-click functionality requires seamless integration with CRM systems, customer databases, and real-time communication tools to provide immediate and context-aware support.

Secure, Frictionless Experiences

Security is fundamental. We use strict data protection, identity verification, e-signatures and file sharing protocols to build trust. This also helps in reducing legal risks as we are not using third party messaging apps to keep the conversation within the bank’s secure environment. Advanced encryption standards, multi-factor authentication (MFA), and end-to-end encrypted communication channels are integral components of a secure Digital Workspace environment. These measures not only safeguard sensitive data but also ensure compliance with regulatory requirements.

Empowered Workforce

The right tools enable every bank staff member to assist customers from anywhere in the network. Through an extensive training program that provides product knowledge and technological competencies along with specialized skill sets organizations maintain consistently high service levels. The approach builds new career paths which drive employee motivation and produce better service quality.

Driving Sales and Revenue

The Digital Workspace represents a key opportunity for banks to generate new sources of revenue. By integrating data analytics, campaign management, and CRM systems, employees can provide tailored products and services at the right time, increasing cross-sell and upsell conversions. When done correctly, Digital Workspace increases both customer satisfaction and bank’s bottom line.

The Digital Workspace is not merely a technological upgrade—it’s a strategic, organizational, and cultural transformation. By merging robust technology with empowered talent, banks can deliver personal, secure, and efficient services at scale.

Explore deep-dive content to help you stay informed and up to date

Financial Services

Financial Services

Financial Services

Financial Services