Financial Services

Financial Services

- Insights

- Financial Services

- Article

How Can Banks Go Beyond Being Just a Transaction Engine in Wealth Management?

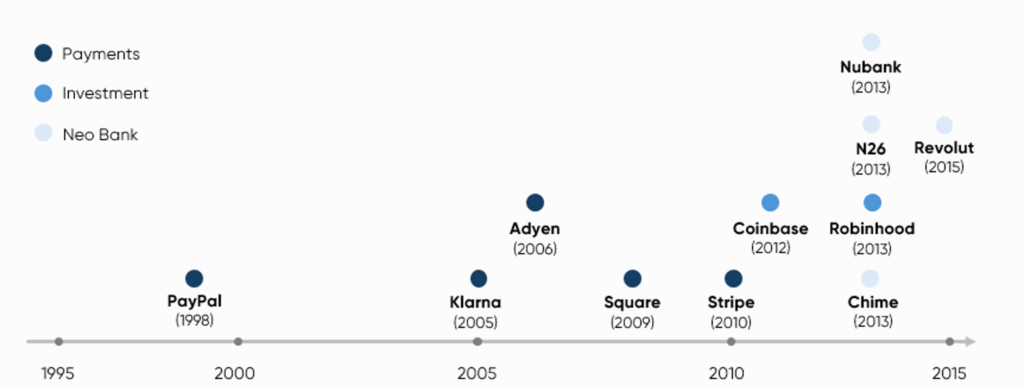

The financial services industry has undergone significant disruption over the past few decades, largely driven by the emergence of fintech companies. As illustrated in the timeline below, the first wave of innovation began with revolutionizing the payments sector, starting with Paypal in 1998. This was followed by notable players like Adyen, Klarna, and Square, each contributing to the reshaping of financial transactions

The second wave saw the rise of investment-focused fintechs such as Coinbase and Robinhood, which democratized access to investment opportunities. The most recent evolution has been the emergence of neo-banks like Nubank, N26, and Revolut, which have redefined traditional banking services through digital platforms.

With the rise of Web3, this disruption has reached unprecedented levels, forcing incumbent players to adopt a new perspective to remain competitive. In this article, I will share DefineX’s approach to helping banks navigate this complex landscape. Specifically, I will discuss how banks can respond to increased competition from wealth management fintechs by democratizing services traditionally reserved for affluent customers.

Decacorn Fintechs with the founding dates and focus areas

Before delving into the details of the DefineX wealth management framework, it is important to benchmark the main players in the market to understand how they differentiate themselves and gain a competitive edge. By analysing the Turkish market using our comprehensive list of evaluation criteria categorized under 6 main categories, we have identified different strategies among different types of financial institutions.

As shown in the figure below, banks stand out primarily due to their digitally rich customer base. Their long-standing trust and familiarity with customers give them an inherent advantage in reaching and retaining customers through digital channels. Digital players are intensifying the competition by focusing on content creation and user-friendly interfaces. These companies are leveraging technology to deliver engaging and easily accessible financial content, improving customer experience and engagement. Meanwhile, brokerage firms are carving out their niche by emphasizing advisory services. This focus on tailored, professional investment advisory helps them stay competitive in a crowded marketplace. In contrast, private pension companies lag behind in terms of maturity across all benchmark categories when compared to other market competitors.

Wealth Management Players Benchmark

Building Key Capabilities to be Forerunner in Wealth Management

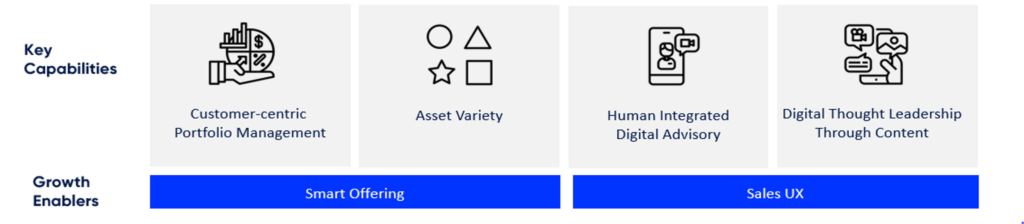

The DefineX wealth management framework offers a holistic approach designed to leapfrog the competition. The framework consists of two main layers: key capabilities and growth enablers. Key capabilities are distinctive features that differentiate your services from the competition, while growth enablers are strategies and tools that increase customer engagement and reduce the effort required for customers to use your services.

In the remaining sections of this article, we will explore the key capabilities banks need to excel in wealth management. For an in-depth exploration of the growth enablers, I recommend reading our published article “For Banks, Excellence in Digital Sales is not as Unreachable as You Think”.

DefineX Wealth Management Framework

Enable customer-centric portfolio management

As the number of investment alternatives increases, smart customer portfolio management has become more crucial than ever. With so many options available, customer confusion is inevitable, and it is at this point that offering customer portfolio management services becomes critical to successful wealth management. Unfortunately, when we analyse existing customer portfolio management services for retail banking mass customers, we find that many current applications fall short when it comes to providing personalized services and generating smart insights that support effective portfolio management.

Customers have diverse backgrounds, family lives, levels of financial literacy, risk appetites, and investment histories. How can a one-size-fits-all service deliver value in such a diverse landscape? To overcome this challenge, banks should adopt a customer-centric approach that addresses individual needs and preferences. Here are the key steps:

- Enhance digital channels: Gain deeper insights into customer investment profiles through advanced data analytics and user experience. For example, you can use interactive questionnaires to assess your customers’ investment goals and their level of financial literacy. Leveraging this data, advanced analytics can create detailed customer investment profiles.

- Deliver tailored services: Optimize asset and product allocation to generate maximum value for each customer. Use data analytics and robo-advisors to create personalized portfolio recommendations from alternative investment instruments based on customers’ investor profiles and goals. This approach will support customers in making informed decisions based on their investment preferences.

- Produce smart insights: Generate clear, concise, and actionable reports to monitor portfolio health. While the vast majority of existing banking applications generate reports on the growth of assets as a result of investments, they often fail to provide insight into missed investment opportunities or alternative scenarios. By providing multi-perspective insights, customers can discover new investment opportunities.

- Offer on-demand online evaluation sessions: Provide customers with the opportunity to adjust their portfolios by assessing investment returns and identifying recent missed opportunities. These sessions can help customers stay on track with their financial goals and adapt to changing market conditions.

Enrich your menu with new assets

To truly excel in wealth management banks must offer a diverse range of assets that meet the unique needs of their target customer groups – especially those not currently available in the market. While traditional investment products remain valuable, growth will come from introducing products with a differentiated value proposition. We believe that there are two main ways to enhance asset variety:

- Broaden the product portfolio: Move beyond traditional financial products to include non-financial assets. For example, banks can enable their customers to invest in art tokenization. This approach attracts a wider range of customers.

- Innovate existing financial products: Enhance product market fit by innovating within existing categories. For example, Midas, an investment app founded in 2020, reached over 2 million customers by introducing fractional stock investment for foreign stocks. This innovation allowed anyone to invest in foreign stocks, regardless of the amount. Considering that the cost of a single NVIDIA share is twice the minimum wage in Turkey, this was a bold and impactful move that significantly increased accessibility.

Designing your service portfolio with a deep understanding of who your target customers are, what they need, and how existing solutions fall short will be a cornerstone of your growth journey.

Bring the expert and the customer together in a digital channel

As demand for wealth management services grows among retail banking customers, gone are the days of serving only affluent customers. The net financial wealth held by mass retail customers is expected to double to $22 trillion by 2030. Despite this growth, nearly %60 of customers seek financial advice, highlighting a significant untapped potential for digital advisory services.

As banks’ digital active customer ratio increases to 85-90%, enabling advisory services by introducing the human factor through digital channels becomes a hygiene factor for being a one-stop shop for investors. The pandemic has accelerated the shift to digital banking, making it unrealistic to expect customers to visit branches for advisory services. Therefore, it is necessary to connect human advisors with customers on digital channels and create a unified space where they can interact and transact together.

In order to create a digital advisory space, banks need to focus on three main pillars:

- Micro-moment based holistic customer journeys: Design customer journeys that capture and respond to critical moments in real time, providing timely and relevant advice. For example, if high customer lifetime value clients are experiencing problems due to low credit card limits, offer advisory services on steps to increase their credit card limits, such as updating monthly income information.

- Robust technology stack: Implement a technology infrastructure that supports interactions between bank experts and customers via mobile banking and enables collaborative transactions within the same session

- Innovative service model: Develop a service model that connects the right expert with the customer when needed, optimized through efficient resource management.

Without a well-designed implementation of these three pillars, any initiative will remain a well-intentioned effort that does not go beyond providing video conferencing in digital banking.

Nurture your customers intellectually as a thought leader

Gone are the days of simply enabling investment transactions through digital channels, especially in wealth management. To transition from being a transactional service provider to an all-in wealth management platform, becoming a thought leader is essential. Unlike everyday banking and lending products, investment decisions require significantly much more information and have a critical impact on future wealth. At this point, providing customers with the necessary information is crucial.

Financial service providers aiming for thought leadership should focus on three main objectives:

- Increase financial literacy: Only 7% of Turkish households are financially literate. By educating customers about financial concepts, banks can empower them to make informed decisions. For example, Midas provides 50 different short courses through Midas Academy to teach investment fundamentals such as dividends, profit-earnings ratio. Similarly, Odeabank Akademi’O is another successful initiative aimed at increasing financial literacy.

- Guide digital channel usage: Clearly explain how to use your digital channels to make investments that will accelerate the adoption of your services. Given that an average banking application has at least 500 functions, users naturally struggle when switching to a new bank. Therefore, it is necessary to support users with “How to” programs until they become accustomed to performing transactions within the application.

- Support investment decisions with financial analyses: Provide insightful and accessible financial analysis to help customers make informed decisions. Platforms like Fintables and Finfree are successful examples that emerged because traditional players were not adequately providing investors with financial analysis and insights. These platforms focus on making information that supports investment decisions easily understandable for everyone by using visuals and interactive graphics.

To establish thought leadership and achieve these goals, a well-defined content strategy is crucial. This strategy should include educational content, how-to guides, and regular financial insights. For an in-depth discussion on developing and executing a content strategy, I recommend reading “Which Path Should Financial Service Providers Follow to Make a Difference Thought Leadership?”, where we discuss this topic in detail.

We see that competition in the industry is leading to democratization by making wealth management more accessible. Although traditional players remain the first choice for customers because of the trust they have built over the years, new players are increasingly reaching a broader customer base with new products and services. The focus areas addressed in this article merit extensive discussion. In subsequent articles, we will take a closer look at each focus area.

https://www3.weforum.org/docs/WEF_Future_of_Capital_Markets_2022.pdf

Explore deep-dive content to help you stay informed and up to date

Financial Services

Financial Services

Financial Services

Financial Services

Key Success Factors for Innovative Banking Products in Embedded Finance

Read now Financial Services

Financial Services